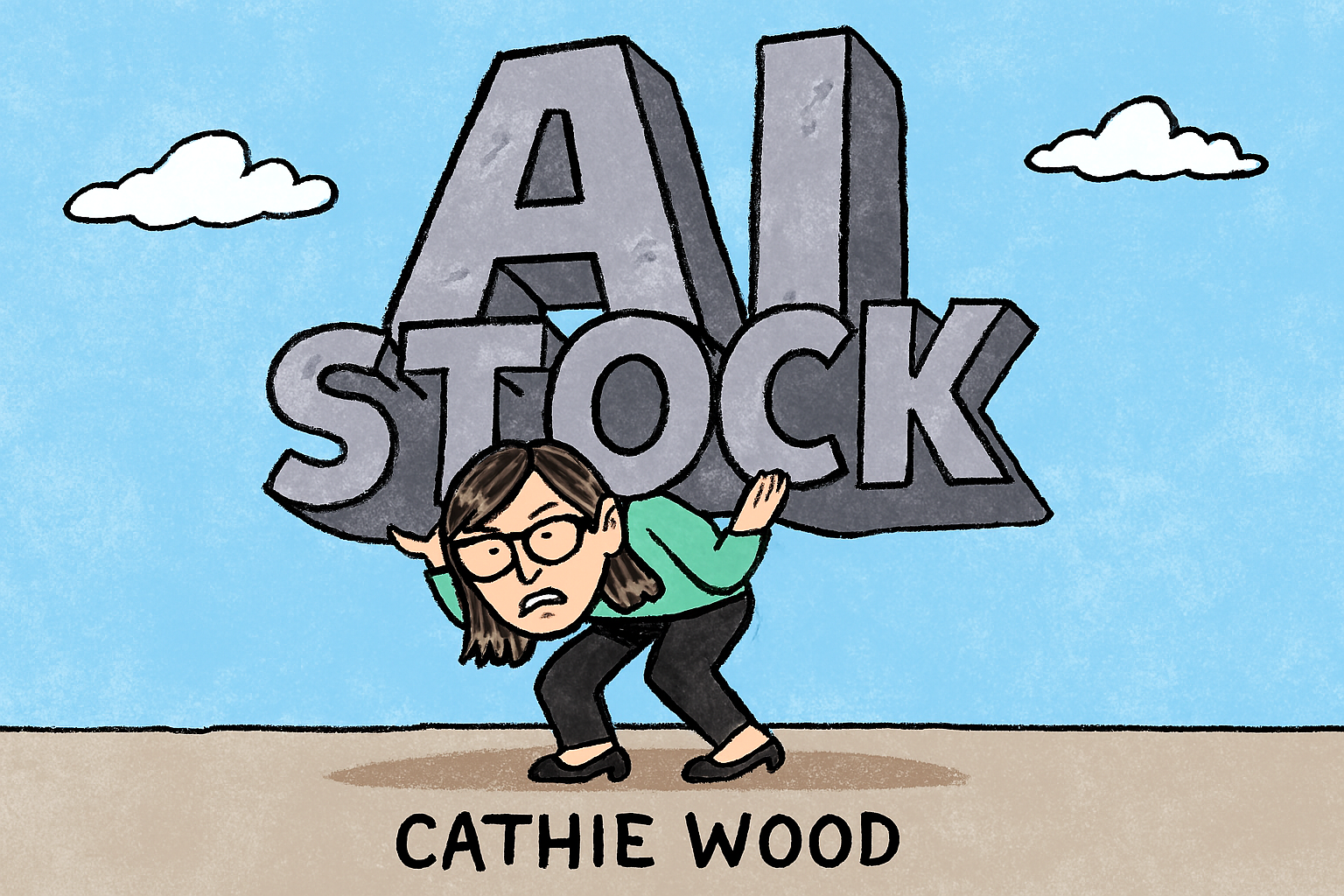

Cathie Wood, CEO of ARK Invest, has once again stirred debate in financial circles by cautioning that the artificial intelligence (AI) sector may be growing top-heavy.

While she remains bullish on the long-term potential of AI technologies, Wood has signalled concern over the concentration of capital in a handful of dominant players—particularly those driving the S&P 500’s recent surge.

Speaking during a recent investor forum in Saudi Arabia, Wood dismissed fears of an outright AI bubble but acknowledged the risk of valuation corrections as interest rates climb and market exuberance outpaces fundamentals.

Her remarks come as ARK Invest continues to rebalance its portfolio, trimming exposure to overvalued tech giants while increasing stakes in emerging AI innovators such as Baidu and Robinhood.

Wood’s flagship ARK Innovation ETF (ARKK) has rebounded sharply in 2025, up over 87% year-on-year, largely fuelled by AI-related holdings.

Yet she reportedly remains wary of the ‘Mag 7’ effect—where a small cluster of mega-cap stocks like Nvidia, Microsoft, and Alphabet dominate investor attention and index weightings.

Strategy

This concentration, she argues, distorts broader market signals and risks sidelining promising mid-cap disruptors.

In response, ARK has shed positions in AMD and Shopify while doubling down on Baidu, a move that reflects Wood’s belief in underappreciated AI plays beyond Silicon Valley.

Her strategy underscores a broader thesis: that the next wave of AI growth will come from decentralised platforms, edge computing, and global innovators—not just the usual suspects.

While critics remain divided on her timing and tactics, Wood’s portfolio adjustments suggest a nuanced approach—one that embraces AI’s transformative power while resisting the gravitational pull of overhyped valuations.

For investors watching the sector’s evolution, her message is clear: beware the weight of giants.