The short answer is no! AI hasn’t peaked in terms of potential—but the market frenzy around it may well be in bubble territory.

🚀 Signs of a Bubble?

- Valuations vs. Earnings: The top 10 companies in the S&P 500—heavily weighted toward AI giants like Nvidia, Microsoft, and Apple—are more overvalued today than during the dot-com boom.

- Retail Frenzy: Retail investors are piling into AI stocks, often driven by hype rather than fundamentals. Meme stocks and AI-branded crypto tokens are surging again.

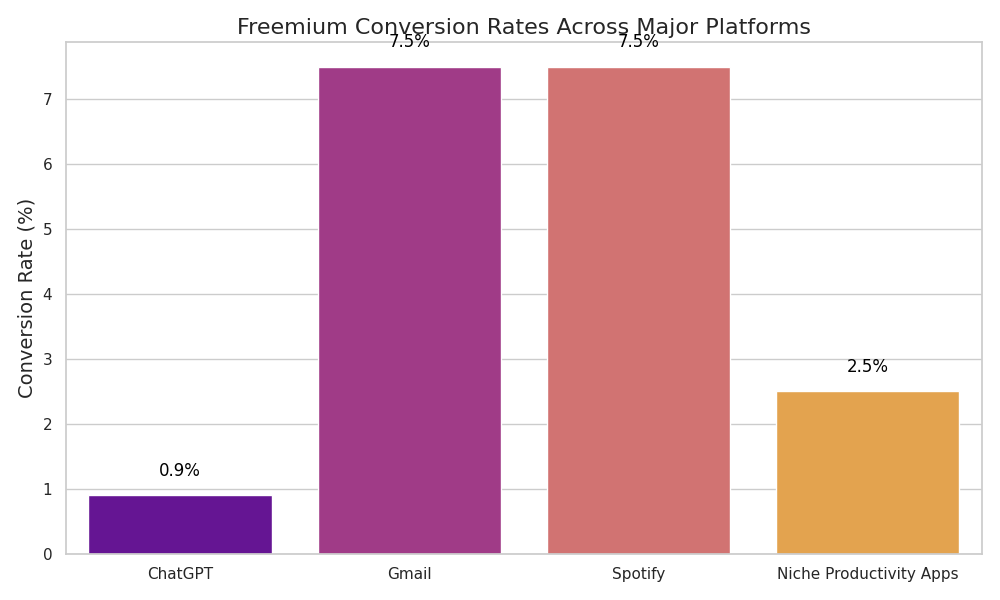

- Low Conversion Rates: Despite massive user numbers, paid adoption is weak. OpenAI’s ChatGPT has 1.5 billion monthly users, but only 0.96% pay for it. That’s a poor monetisation ratio compared to services like Gmail. However, commercial uptake is far higher.

- Unsustainable Business Models: Many AI startups operate at huge losses, relying on speculative funding rather than sustainable revenue.

🧠 But Has AI Peaked Technologically?

No-way – not even close.

- Agentic AI: Models like GLM-4.5 from China and Anthropic’s Claude are pushing toward autonomous task decomposition—meaning smarter, more efficient systems.

- Enterprise Integration: AI is transforming workflows in law, medicine, and finance. Companies like RELX are embedding AI into decision-making tools with real-world impact.

- Hardware & Infrastructure: Microsoft and Nvidia are investing billions in AI infrastructure, suggesting long-term belief in its utility—not just hype.

What Comes Next?

- Rebalancing: Like the dot-com crash, we may see a correction. Overhyped firms could fall, while those with real utility and revenue survive and thrive.

- Regulatory Pressure: Governments are starting to scrutinise AI’s economic and ethical impact. That could reshape the landscape.

- Investor Reality Check: As soon as investors stop chasing hype and start demanding profitability, the bubble may deflate.

Less than 1% of users currently pay for ChatGPT (is this a failure to monetise or massive future potential to unfold)?

Remember how long it took Google to monetise its search engine in the beginning? Think – MySpace, Yahoo, AOL and others?

As of mid-2025, OpenAI ChatGPT has around 1.5 billion monthly users, but only a tiny fraction pay for premium plans like ChatGPT Plus ($20/month) or Pro ($200/month).

While OpenAI hasn’t published exact conversion rates, multiple industry analysts estimate that fewer than 1% of users are paying subscribers, based on app store revenue data and internal usage leaks.

This low monetisation rate is striking when compared to other freemium models:

- Gmail and Spotify convert ~5–10% of users to paid tiers

- Even niche productivity apps often hit 2–3%

| Platform | Conversion Rate |

|---|---|

| ChatGPT | 0.9% |

| Gmail | 7.5% |

| Spotify | 7.5% |

| Niche Productivity Apps | 2.5% |

| Platform | Conversion Rate |

|---|---|

| Spotify | 7.5% |

| YouTube Music | 4.2% |

| Apple Music | 6.8% |

| Deezer | 3.9% |

| Amazon Music | 5.1% |

So, despite massive reach, ChatGPT’s revenue per user is still very low. That’s one reason why some analysts argue the AI market is in a bubble: huge valuations, but weak direct monetisation.