I can see and hear and speak…

OpenAI’s ChatGPT can now ‘see, hear and speak,’ or, at least, understand spoken words, respond with a synthetic voice and process images, the company announced Monday 25th September 2023.

The update to the chatbot OpenAI’s biggest since the introduction of GPT-4, allows users to opt into voice conversations on ChatGPT’s mobile app and choose from five different synthetic voices for the bot to respond with. Users will also be able to share images with ChatGPT and highlight areas of focus or analysis.

Roll out

The changes will be rolling out to paying users in the next two weeks, OpenAI said. ‘While voice functionality will be limited to the iOS and Android apps, the image processing capabilities will be available on all platforms’.

The big feature push comes alongside ever-rising stakes of the artificial intelligence (AI) race among chatbot leaders such as OpenAI, Microsoft, Google and Anthropic. In an effort to encourage consumers to adopt generative AI into their daily lives, tech giants are racing to launch not only new chatbot apps, but also new features. Google has announced updates to its Bard chatbot, and Microsoft added visual search to Bing.

Investment expansion

Earlier this year, Microsoft’s expanded its investment in OpenAI, an additional $10 billion, it made it the biggest AI investment of the year. In April 2023, the startup reportedly structured a $300 million share sale at a valuation of between $27 billion and $29 billion, with investments from firms such as Sequoia Capital and Andreessen Horowitz.

Concerns

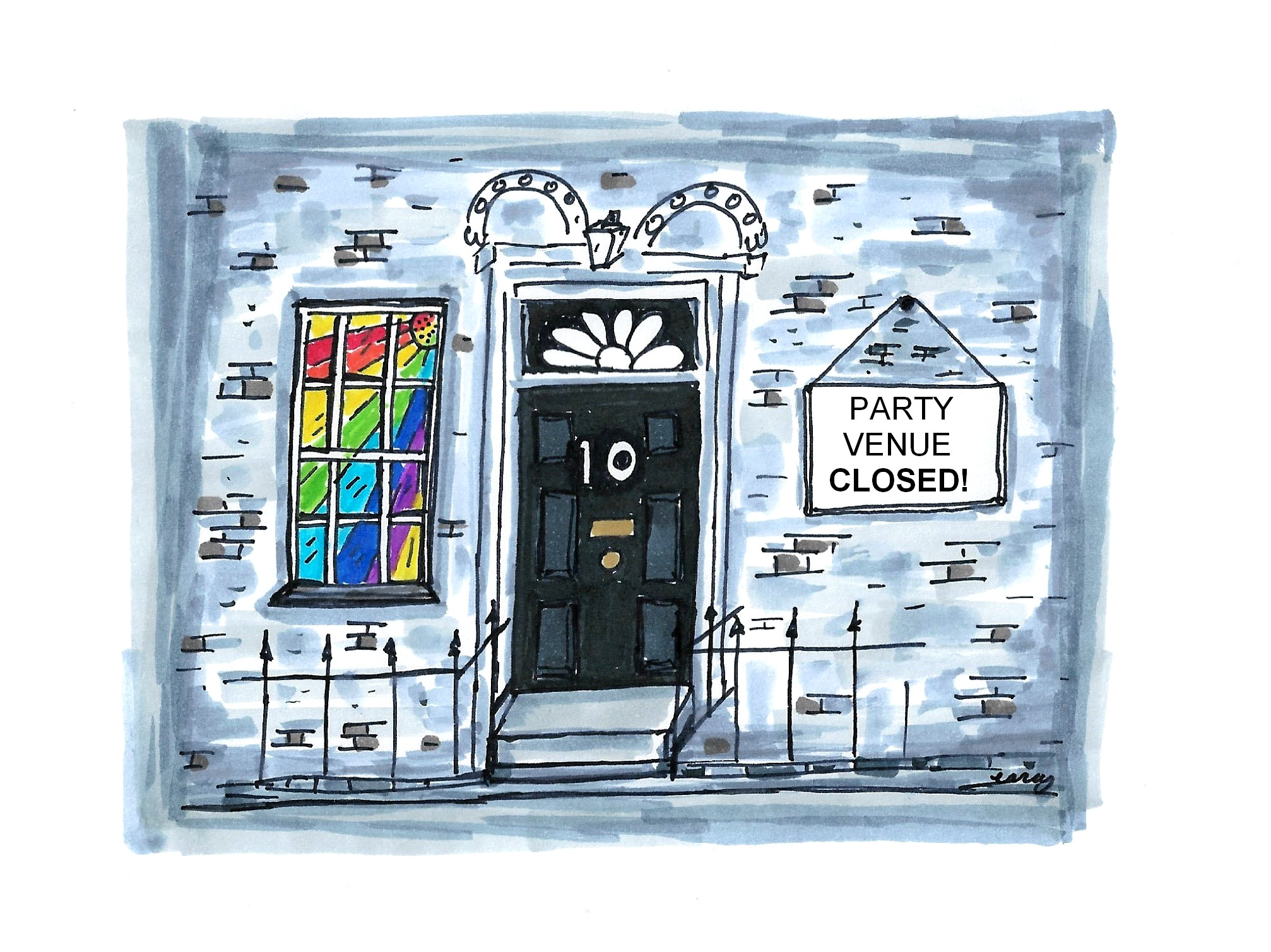

Experts have raised concerns about AI-generated synthetic voices, which in this case could allow users a more natural experience but also enable more convincing deepfakes. Cyber threat investigators and researchers have already begun to explore how deepfakes can be used to penetrate cybersecurity systems.

OpenAI acknowledged those concerns in its announcement, saying that synthetic voices were ‘created with voice actors we have directly worked with,’ rather than collected from strangers.

The release also provided little information about how OpenAI would use consumer voice inputs, or how the company would secure that data if it were used. OpenAI did not immediately respond to CNBC’s request for comment, and the company’s terms of service say that consumers own their inputs ‘to the extent permitted by applicable law.’

What does ‘ChatGPT’ actually mean?

ChatGPT is an acronym for Chat Generative Pre-trained Transformer. It is a name of an artificial intelligence model that can generate natural language text based on user input.

It was developed by OpenAI, a research organization dedicated to creating and ensuring the safe and beneficial use of artificial intelligence (AI). ChatGPT can be used for various purposes, such as answering questions, having conversations, and producing creative writing.