‘Meet our new political adviser!’

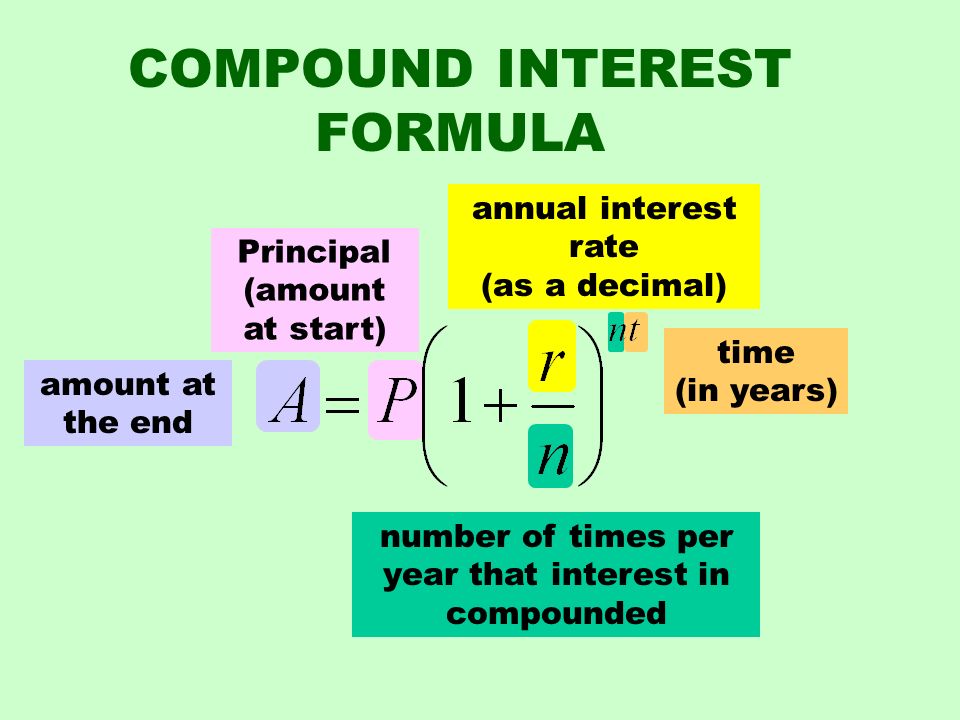

Compound interest is simply interest added back to the original or principal sum and then more interest is earned or calculated on ‘that’ added interest over the next compounding period.

Over a one year period: Take £1000 capital and add 5% interest (lucky if you can get it). That equals to £1050. That’s 1000 x 5% over 1 year = £1050.

Now this is the best bit…

Take your £1050 from the first year (original capital plus interest). Now, in year two it goes like this…

Take the new value £1050 capital add 5% interest again (but this time it is added to £1050 not just the original £1000).

That’s 1050 x 5% equals £1102.50 we’re compounding the interest on the £50 earned in the first year as well as the original capital.

It will be £1102.50 x 5% = £1157.63 and so on.

You can clearly see why it is important to take advantage of compound interest. Leaving your money in a savings account right now with such low interest rates isn’t a wise option. But when/if you can find a sensible interest rate COMPOUND interest will be your best friend.

Don’t just take my word for it. Compound interest is in very good company.

‘Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.’

He called it, ‘the greatest mathematical discovery of all time.’

Start £100,000.00

Year 1 £105,000.00

Year 2 £110,250.00

Year 3 £115,762.50

Year 4 £121,550.63

Year 5 £127,628.16

Year 6 £134,009.56

Year 7 £140,710.04

Year 8 £147,745.54

Year 9 £155,132.82

Year 10 £162,889.46

Year 1 £5,000.00

Year 2 £5,250.00

Year 3 £5,512.50

Year 4 £5,788.13

Year 5 £6,077.53

Year 6 £6,381.41

Year 7 £6,700.48

Year 8 £7,035.50

Year 9 £7,387.28

Year 10 £7,756.64

It’s time to compound your savings.

What are you waiting for… go do it now!