In years past, the mere hint of U.S. airstrikes or heightened geopolitical tension would send global stock markets into panic mode.

Yet, following President Trump’s re-election and his increasingly aggressive foreign policy stance, investor reactions have become notably muted.

From missile strikes on Iranian nuclear sites to an orchestrated ceasefire between Iran and Israel, markets have barely flinched. The question arises: are investors becoming desensitised to Trump’s geopolitical theatre?

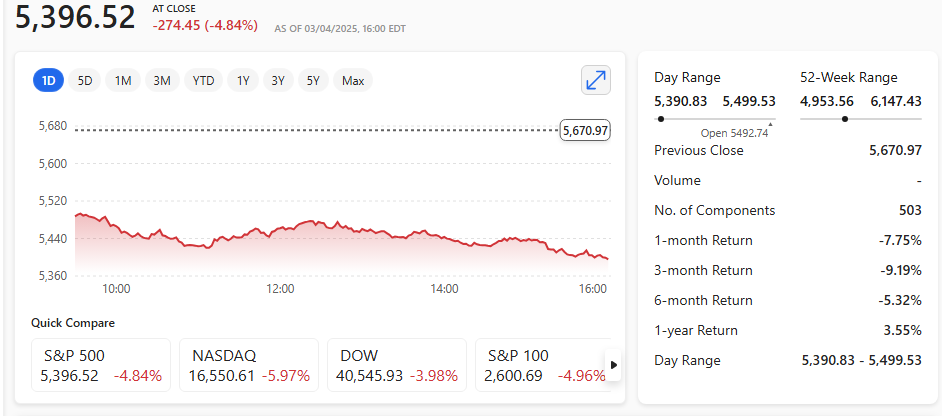

Take the latest skirmish between Iran and Israel. After nearly two weeks of missile exchanges, Trump’s announcement of a ‘complete and total ceasefire’ barely nudged the S&P 500.

That calm came despite the U.S. launching pre-emptive strikes on Iranian facilities and absorbing retaliatory attacks on its military base in Qatar.

In another era, or under a different administration even, such developments might have triggered a broad risk-off sentiment. Instead, Wall Street just shrugged.

One reason may be fatigue. Trump’s approach – rife with tariffs, sanctions, and sudden reversals – has bred a kind of market immunity.

Investors, well-versed in the rhythm of Trump’s provocations, have begun treating them as background noise. His revived tariff agenda, particularly the threats aimed once again at China and EU auto imports, has likewise failed to prompt major selloffs.

Similarly, the ongoing Russia-Ukraine conflict, once a source of intense volatility, now registers as a strategic stalemate in the market’s eyes.

While Trump’s rhetoric surrounding Ukraine has shifted unpredictably, investors appear more focused on earnings, inflation data, and central bank signals than on diplomatic fallout and war!

This is not to suggest markets are indifferent to geopolitical risk, but rather that they’ve adapted. Algorithmic trading models may be increasingly geared to discount Trump’s headline-grabbing tactics, while institutional investors hedge through gold, volatility indices, or energy plays without dumping equities outright.

Critics argue this detachment is dangerous. Should a flashpoint spiral out of control, be it over Hormuz, Ukraine, or Taiwan, the slow-boiling complacency could leave portfolios badly exposed.

Still, for now, Trump’s policies are being priced in not with panic, but with complacency maybe.

The real story may not be what Trump does next, but how long the markets can continue to look away.

Trump announces he had brokered ceasefire between Israel and Iran?

Tensions between Israel and Iran reached a boiling point after 12 days of cross-border missile and drone strikes.

The situation escalated further when U.S. forces under President Trump launched targeted airstrikes on key Iranian nuclear sites, Fordow, Natanz, and Isfahan, prompting a direct Iranian missile response on a U.S. base in Qatar.

In a dramatic turn, President Trump announced what he called a ‘Complete and Total CEASEFIRE‘ – announced on Truth Social. According to Trump’s plan, Iran would begin the ceasefire immediately, with Israel to follow 12 hours later.

The truce would reportedly be considered complete after 24 hours if all attacks stopped.

While Trump touted the ceasefire as a triumph of ‘peace through strength’, analysts questioned the ceasefire’s enforceability – especially since missile exchanges reportedly continued despite the announcement.

Nonetheless, Trump claimed credit for halting the region’s slide into all-out war without committing to prolonged U.S. military involvement.

Critics argue Trump’s strategy relies more on military pressure and media theatrics than diplomatic engagement.

Supporters counter that his boldness forced both sides to the table. Either way, the world is watching to see whether this fragile peace endures – or erupts again in fire.

If this turns out to be a masterstroke in political brinkmanship – hats off to Trump, I guess. Whichever way you look at it, the precision U.S. strike on Iran was exactly that – precision. And, you have to take note.

Iran has been weakened, and this may even influence Russia’s war on Ukraine. Hopefully Israel with Palestine too – regardless of stock market reaction.

And that has to be a good thing!

But has Israel finished their war?

Despite all the noise regarding stock market reaction, one thing is for certain – the anxiety and worry for the people of the Middle East is unquestionable.

It’s not a happy time.