Election year 2024 – vote for me!

Year-on-year inflation hit nearly 65%, according to the Turkish Central Bank’s figures released Monday 5th January 2024

The consumer price index (CPI) for the country of 85 million people increased by 64.86% annually, up slightly from the 64.77% of December.

Sectors with the largest monthly price rises were health at 17.7%, hotels, cafes and restaurants at 12%, and miscellaneous goods and services at just over 10%. Clothing and footwear were the only sectors showing a monthly price decrease, with -1.61%.

Food, beverages and tobacco, as well as transportation, all increased between roughly 5% and 7% month-on-month, while housing was up 7.4% since December 2024.

Interest rate hike to 45%, see report here.

In the interview and after last week’s Federal Open Market Committee meeting (FOMC), Powell expressed confidence in the economy. However, he promised he wouldn’t be swayed by this year’s presidential election and said the pain he feared from rate hikes never really materialised.

“With the economy strong like that, we feel like we can approach the question of when to begin to reduce interest rates carefully,” he reportedly said.

“We want to see more evidence that inflation is moving sustainably down to 2%,” Powell added. “Our confidence is rising. We just want some more confidence before we take that very important step of beginning to cut interest rates.”

Powell indicated that it was unlikely the FOMC will make that first move in March 2024, which markets have been anticipating.

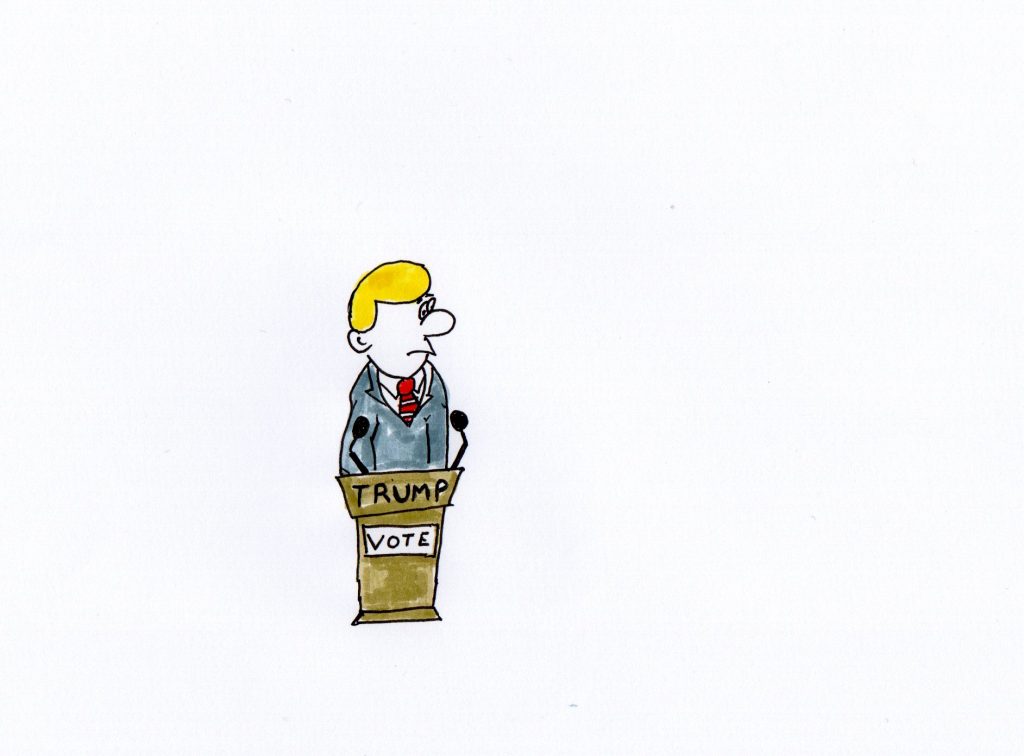

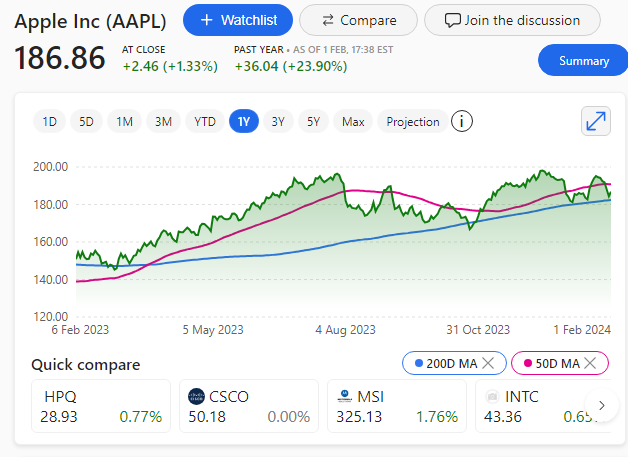

Three of the Magnificent 7 results dominated the headlines: Meta, Amazon and Apple. Nasdaq and S&P 500 gained in ‘after the bell’ trading. This after a punishing day for Alphabet and Microsoft, despite good results.

Nasdaq 100 closed at: 17344 but climbed above 17500 in after-hours trading.

Shares of Meta surged 15% after the social-media giant defied analysts’ estimates. It posted earnings of $5.33 per share on revenue of $40.11 billion. The company also declared its first-ever dividend payment. Share buy-back was also announced.

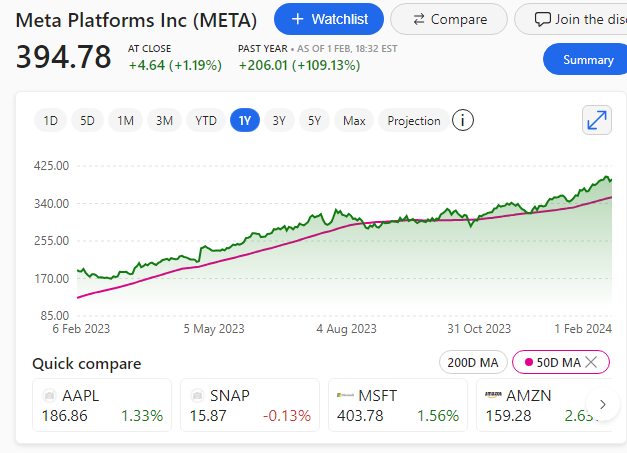

Investors also enjoyed Amazon’s earnings, which easily topped Wall Street’s predictions. The ecommerce giant also provided a strong positive outlook. The stock jumped 7% in extended trading.

Q4 was a record-breaking Holiday shopping season in the U.S. and closed out a robust 2023 for Amazon. Amazon has much planned for 2024.

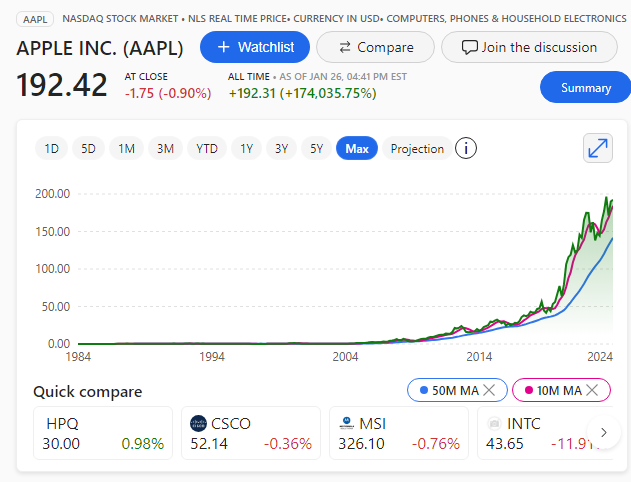

But Apple didn’t benefit from the same treatment despite posting strong results.

Apple also exceeded estimates, reporting revenue growth for the first time in a year. But shares slid more than 2% in extending trading after it posted a 13% decline in sales in China.

Apple’s outlook suggesting weak iPhones sales may have also disappointed investors.

As the AI market expands so too will AI powered personal computer (PC). These are personal computers embedded with processors specifically designed to perform AI functions such as real-time language translation. Intel has already announced its AI powered chip for the PC.

Tech research firm Canalys in a December report said the boom in generative AI is expected to boost PC sales as consumers are seeking devices with AI features, predicting that 60% of the PCs shipped in 2027 will be AI-capable.

An explosion of interest in AI was sparked by the launch of ChatGPT in November 2022 as the chatbot went viral for its ability to generate human-like responses to users’ prompts.

Microsoft was quick to adopt the Technolgy and incorporate AI into its Bing search engine. Other companies such as Amazon, Alphabet (Google), Arm, Meta, Tesla and Apple are all heavily involved in AI development too.

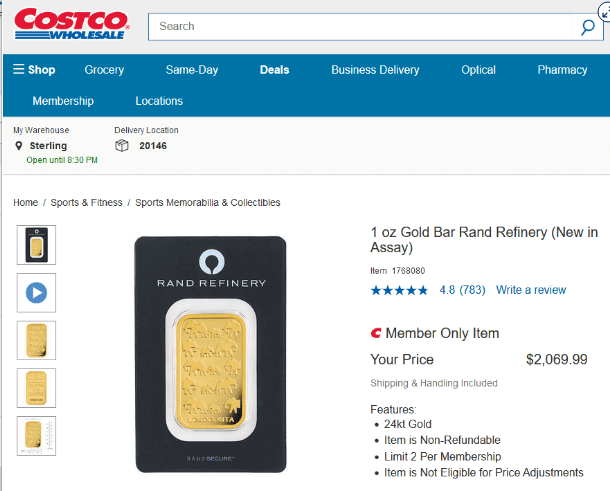

Total gold demand stood at 4,899 tons in 2023 compared to 4,741 tons in 2022. Gold purchases from central banks led to last year’s surge, with purchases exceeding 1,000 tons for two consecutive years.

Prices reached an all-time high of around $2,135 an ounce in December 2023 as central banks and retail buyers increased their gold investments.

Buyers have many outlets from which to make their gold purchases. Costco recently reported selling over $100 million worth of gold bars in the final quarter of December 2023. Weird to think that we can now buy carats with carrots.

According to some analysts’ gold purchases this year are unlikely to meet 2023 levels, but a fall in inflation could prevent a drastic drop in demand.

When inflation drops significantly, consumers will start to feel ‘better-off’, and this could mitigate some of the drop in demand.

A Gold carat is a unit used to measure the purity of gold, with a carat representing 1/24th part of the whole.

Pure gold is 24 carats, meaning that it is 100% gold with no other metals added. However, gold used for jewellery and other applications is rarely pure, and its purity is measured in carats to determine its value.

It is the fourth time in a row the Bank has held rates at 5.25%.

The Bank of England had previously raised rates 14 times in a row to curb inflation, leading to increases in mortgage rates but also creating better rates for savers.

There is a noticeable shift in opinion as the committee entertained the possibility of discussing the feasibility of cuts.

There was a three-way split, with two members of the Monetary Policy Committee (MPC) voting to increase the bank rate to 5.5%; one to reduce it to 5%; and six were in favour of sticking with 5.25%.

With inflation falling it is very likely the interest rates will be reduced by 0.25% by March 2024. Just take a look at the reduction in savers rates that have already occurred.

The anticipation is for a rate reduction soon.

The clue is that savers rates are being cut.

The Bank of England Governor, Andrew Bailey, has made clear that for him the key question is: ‘For how long should we keep rates at the current level?’

There may be disappointment ahead then – but a rate cut is next and I still expect it by Easter.

The bank failed to accurately identify deposits eligible for the UK’s Financial Services Compensation Scheme, the Bank’s Prudential Regulation Authority (PRA) announced.

HSBC was fined by the Bank of England’s Prudential Regulation Authority (PRA) for failing to properly implement the depositor protection rules, which are meant to safeguard customer deposits in case of a bank collapse.

The PRA said the failings were ‘serious‘ and ‘materially undermined the firm’s readiness for resolution’. HSBC reportedly said it was pleased to have resolved the ‘historic matter’ and cooperated with the investigation. The ‘failings’ occurred between 2015 and 2022. The fine is the second highest to date imposed by the regulator.

Under the scheme, customer deposits are protected up to the value of £85,000.

Under depositor protection rules, banks must have systems and controls in place to make sure that financial information is logged correctly. This information is needed if the FSCS has to make payments to customers upon a bank collapse.

However, the PRA said HSBC Bank incorrectly marked 99% of its eligible beneficiary deposits as ‘ineligible’ for FSCS protection.

Unfortunately this episode doesn’t give me much faith in the banking system that is supposed to protect the ‘saver’. At least the PRA discovered the failings.

But a cut anytime soon is unlikely until inflation is brought fully under control and nearer to the Fed’s 2% inflation target.

The Federal Reserve sent a signal that it is finished with raising interest rates but made it clear that it is not ready to start cutting, just yet. It also said there are no plans yet to cut rates with inflation still running above the central bank’s target.

In after-hours trading, shares of Alphabet dropped more than 5%, while Microsoft slipped 2% after the tech giants, part of the Magnificent Seven posted quarterly earnings. However, both companies achieved on both top and bottom lines. However, advertising revenue for Alphabet came short of analysts’ expectations.

The tech sector powered the market rally from 2023 into 2024 and is now trading at a relatively high valuation of nearly 29 times its 2024 earnings, according to recent figures. Investors will need to see earnings expansion in order for the tech companies to be able to maintain their elevated levels.

Results were good but not good enough according to Wall Street as stocks were priced for perfection and that wasn’t delivered.

Even though the results were better-than-expected, investors are likely selling because they just want to take some money off the table.

Absolute perfection comes at a price on Wall Street.

Elon Musk’s neurotech startup Neuralink implanted its device in a human for the first time on Sunday 28th January 2024, and the patient is ‘recovering well,‘ the entrepreneur said in a post on X, on Monday 29th January 2024.

The company is developing a brain implant that aims to help patients with severe paralysis control external technologies using only neural signals.

Neuralink began recruiting patients for its first in-human clinical trial in the autumn after it received approval from the U.S. Food and Drug Administration to conduct the study back in May 2023, according to a blog post.

Musk, in an X post on Monday 29th January 2024 said that Neuralink’s first product is called Telepathy.

If the technology functions well, patients with severe degenerative diseases such as motor neurone disease could someday use the implant to communicate or access social media by moving cursors and typing with their minds.

Despite high inflation and geopolitical unrest, the equity market in 2023 was strong, compared to a very weak year in 2022. It follows a record loss of 1.64 trillion Norwegian kroner for the whole of 2022, which the fund attributed to ‘very unusual’ market conditions at the time.

Norway’s sovereign wealth fund on Tuesday 30th January 2024 reported a record profit of 2.22 trillion kroner ($213 billion) in 2023, supported by robust returns on its investments in technology stocks.

The ‘Government Pension Fund Global’, one of the world’s largest investors, reportedly said the fund marked its highest return in kroner ever, with the fund’s return on investment last year coming in at 16% for the year.

Norway’s sovereign wealth fund, the world’s largest, was established in the 1990s to invest the surplus revenues of the country’s oil and gas sector. To date, the fund has put money in more than 8,500 companies in 70 countries around the world.

See wealth fund rankings table here

It is the opposite of flashy logos, loud colors, and fast fashion. Quiet luxury is about investing in pieces that are durable, versatile, and refined.

Some examples of quiet luxury brands are Hermes, Prada-owned Miu Miu, Brunello Cucinelli, Compagnie Financière Richemont and Swatch Group, The Row, Totême, Tove and LVMH. Quiet luxury is also influenced by social changes, popular culture, and economic factors. It reflects a desire for simplicity, sophistication, and sustainability in a seemingly never-ending chaotic world.

Quiet luxury was one of last year’s biggest viral fashion trends, but unlike other short-lived fads on TikTok or Instagram, this one has made its way into investor portfolios and shown lucrative returns.

Luxury stocks have long been regarded by some as an effective hedge against inflation.

LVMH shares jumped more than 8% on Friday 26th January 2024, after the world’s largest luxury group posted higher-than-expected sales for 2023 and raised its annual dividend.

The owner of Louis Vuitton, Moët & Chandon and Hennessy, as well as brands including Givenchy, Bulgari and Sephora, on Thursday night 25th January 2024 reported sales amounting to 86.15 billion euros ($93.34 billion) for 2023, forecasts. This equated to a 13% growth from the previous year.

The result was boosted in particular by 14% annual growth in the critical fashion and leather goods sector, along with 11% growth in perfumes and cosmetics. Wines and spirits meanwhile posted a 4% decline.

Bernard Arnault is one of the top 10 wealthiest people in the world.

Is there room in your portfolio for a luxury brand?

It’s true, space has a smell. Space is a vacuum, so no one can smell it directly. But astronauts can smell the things that have been in space, such as their suits or tools.

They report that space smells like hot metal, diesel fumes, barbecue, or burning hydrocarbons. These smells are believed to be caused by the by-products of dying stars, such as hydrocarbons.

Jane Austen was an English novelist known primarily for her six novels. Hew novels implicitly interpret, critique, and comment upon the British landed gentry at the end of the 18th century.

The collaboration with Baidu will facilitate Samsung’s latest Galaxy S24 smartphone series with advanced features such as advanced typesetting, real-time call translation and intelligent summarization.

Samsung recently revealed its latest Galaxy S24 lineup with AI-powered features as it attempts to overtake the Apple iPhone.

Last year, Honor, a spin-off from Chinese company Huawei, held the second spot with almost a 17% market share, followed by Vivo, Huawei and then Oppo.

One of the biggest changes in 2023 was Huawei’s return to the top five in China in the Q4. The iphone has been one of the world’s best-selling selling products of all time.

Since the introduction of the Apple iphone in 2007 by Steve Jobs, its inventor and company joint founder, it has gone on to sell 2.3 billion and has over 1.5 billion ‘active’ users. Not bad for a product that investors initially called ‘dead on arrival’ due to lack of interest and sales.

In 2007 the Nokia 3310 was the clear market leader and easily king of the mobile phone market. Nokia sold 7.4 million units in 2007 – Apple sold just 1.4 million. Nokia was the ‘go to product’. But not for long.

Oh my, how things have changed. Apple is the now the world’s best-selling product (not just the world’s best-selling phone) – with Nokia and many others left trailing in the dust.

It was the apps that done it; having a product that could be any number of different ‘products’ in one and held in your hand was a game changer – and that changed the world.

The rest is history.

Inflation is falling and getting closer to the 2% target

The U.S. easily avoided a recession that many had forecast as inevitable, the U.S. Commerce Department reported Thursday 25th January 2024.

Gross domestic product (GDP), a measure of all the goods and services produced, increased at a 3.3% annualised rate in the final quarter of 2023, according to data from the Commerce Department.

Wall Street consensus was for a figure of 2%.

Core prices for personal consumption expenditures (PCE), a preferred measure by the Federal Reserve as a longer-term inflation calculation, rose 2% for the period, while the rate was 1.7%.

On an annual basis, the PCE price index rose 2.7%, down from 5.9% a year ago, while the core figure excluding food and energy posted a 3.2% increase annually, compared with 5.1%.

Inflation falling, GDP rising, stabilizing interest rates and no recession thus far the U.S. economy is looking rock-solid despite all the negativity.

It comes amid an ongoing struggle against double-digit inflation for Turkey’s policymakers, with the rate hike the latest step in that ongoing fight.

Inflation in Turkey increased nearly 65% year-on-year in December 2023, up from 62% in November, and the country’s currency, the lira, hit a new record low against the U.S. dollar earlier in January 2024 at 30 Lira to $1.

Analysts predict this will be the last hike for some time, especially with local elections approaching in March 2024

The Chancellor, Jeremy Hunt, has given strong hints that he wants to cut taxes in the spring Budget.

Mr Hunt reportedly said that countries with lower taxes have more ‘dynamic, faster growing economies.‘ Didn’t Liz Truss say something like that too? But of course, she didn’t ‘cost it out’ in her mini budget apparently – but she also wanted lower taxes for growth none-the-less.

In the Autumn Statement, the chancellor reduced national insurance for workers by 2% and announced tax relief for businesses. If inflation falls, followed by lower interest rates, Mr Hunt may consider he has scope for further tax cuts.

At the World Economic Forum, in Davos, Switzerland – he was also reported to have said that the: ‘direction of travel’ indicates that economies growing faster than the UK, in North America and Asia tend to have lower taxes. ‘I believe fundamentally that low-tax economies are more dynamic, more competitive and generate more money for public services like the NHS,’ he reportedly said.

It is widely expected that the chancellor will focus on income tax in the upcoming Budget due on 6th March 2024

UK Borrowing fell to £7.8bn in December 2023, the Office for National Statistics (ONS) indicated. Interest payments dropped sharply due to a faster than expected decline in inflation. Analysts said the latest figures could give the chancellor more wiggle room for tax cuts.

December’s borrowing figure was £8.4bn less than a year earlier, and the lowest figure for the month since 2019.

Interest payments on government debt fell to £4bn, down by £14.1bn from December 2022.

It’s true! Little Lego figures outnumber humans.

It is estimated that there are 8.1 billion humans on planet Earth and 10 billion little Lego mini characters.

So, humans are out numbered by Lego minifigures!

The achievement comes nearly two weeks after Microsoft eclipsed Apple as the world’s most valuable public company on 12th January 2024. However, Apple has reclaimed top spot – its market cap closed at around $3.01 trillion on Wednesday 24th January 2024.

Microsoft shares are up more than 7% year to date as investors remain bullish about the company’s investments in artificial intelligence.

It is strongly expected that Microsoft will deliver good results in the Q2 earnings report, because of its leadership position gained in generative AI.