Water scarcity is a pressing global issue and has far-reaching consequences across various industries. One sector significantly affected is semiconductor manufacturing.

How does water scarcity pose a threat to the production of essential microchips.

Water in Semiconductor Manufacturing

Ultra-pure water is a critical resource in semiconductor fabrication plants (fabs). It is used for cleaning, cooling, and various processing steps during chip production.

Microchips power our devices—computers, smartphones, sensors, and LEDs—all of which rely on water-intensive manufacturing processes.

Global Water Scarcity

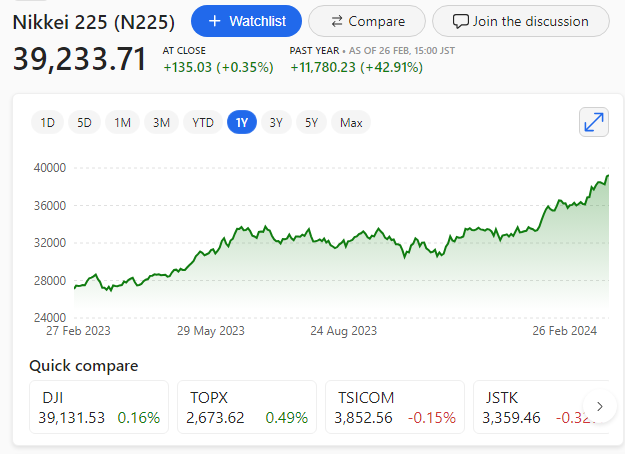

Freshwater availability is unevenly distributed worldwide. While oceans contain 97% of water (mostly saline), accessible freshwater constitutes only a small fraction.

Approximately four billion people experience severe water scarcity for at least one month annually, and half a billion face it year-round.

Taiwan’s Drought and Chip Production

Taiwan, a semiconductor manufacturing hub, faces a severe drought. Over 20% of global microchips are produced there.

Water shortages threaten supply chains, potentially impacting chip production.

Cost and Sustainability

Creating fully self-sufficient local supply chains would cost $1 trillion. Such self-reliance could increase semiconductor costs by up to 65%.

Urgent action is needed to ensure sustainable water management in fabs, as chips control everything from cars to appliances.

In conclusion, water scarcity poses a real danger to semiconductor production. Addressing this challenge requires strategic planning, conservation efforts, and global cooperation.

AI a problem or a solution?

Will the problem of water scarcity exacerbate the uneven distribution of water around the world as the rich have easier access to the precious resource.

Will the explosion of AI tech push the imbalance – water is a basic necessity to maintain human life. Will AI have a hand in controlling the distribution of water – even for its own needs?