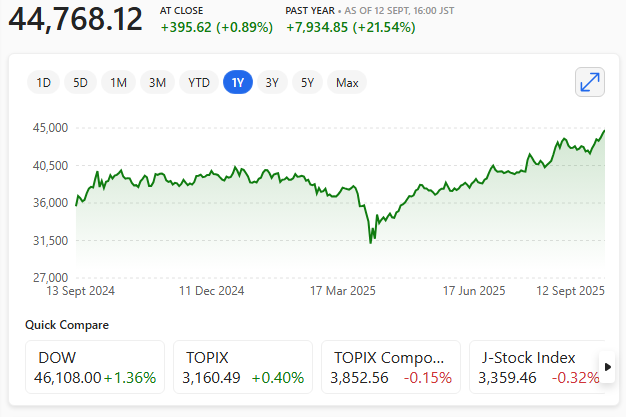

Tokyo, 12th September 2025 — The Nikkei 225 has surged to an all-time intraday high of 44,888.02, before settling at 44,768.12 at the close.

This marks a weekly gain of 3.8%, fuelled by a potent cocktail of AI optimism, global rate-cut hopes, and a tech-heavy rally that has left analysts both exhilarated and uneasy.

Rally

SoftBank Group led the charge, soaring nearly 10% earlier this week to a record 17,885. Its stake in the Stargate AI infrastructure project—alongside Oracle and OpenAI—has positioned it as Japan’s de facto ambassador to the AI gold rush. Investors, it seems, are buying not just stock, but narrative.

Meanwhile, global macro tremors have played their part. A rise in U.S. unemployment and tepid job creation have reignited hopes for a Federal Reserve rate cut, lifting equities worldwide.

Nikkei 225 one-year chart

Japanese industrials and exporters have ridden the wave, with Mitsubishi Heavy Industries up 70% year-to-date, and Fujikura surging 115%.

Even the judiciary has joined the chorus: a U.S. appeals court ruling against Trump-era tariffs has sparked hopes of a reversal, giving Japanese exporters a fresh tailwind.

Speculation or substance?

Yet beneath the euphoria, caution lingers. Investors warn of an ‘overheated’ market, noting that Japan’s equity gains still trail Wall Street’s meteoric rise.

The Nikkei’s ascent, while historic, may be more froth than fundamentals.

AI is driving the gain.