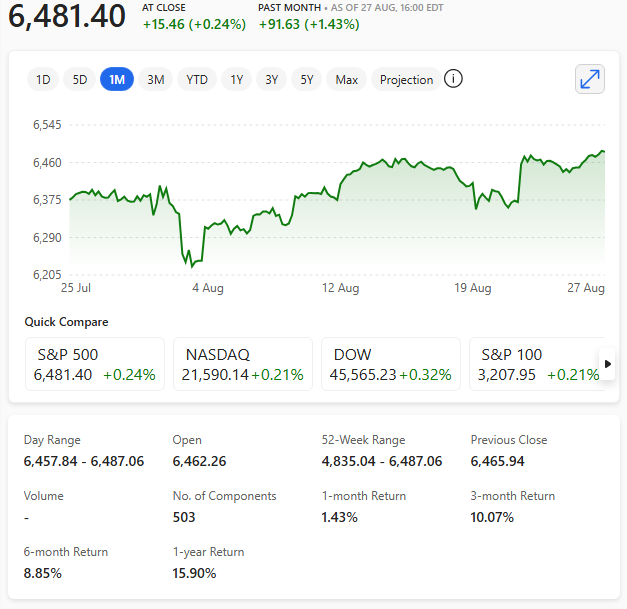

The S&P 500 closed at a fresh all-time high of 6,481.40, on 27th August 2025, marking a milestone driven largely by investor enthusiasm around artificial intelligence and anticipation of Nvidia’s earnings report.

This marks the index’s highest closing level ever, surpassing its previous record from 14th August 2025.

Here’s what powered the rally

- 🧠 AI Momentum: Nvidia, which now commands over 8% of the S&P 500’s weighting, has become a bellwether for AI-driven growth. Despite closing slightly down ahead of its earnings release, expectations for ‘humongous revenue gains’ kept investor sentiment buoyant.

- 💻 Tech Surge: Software stocks led the charge, with MongoDB soaring 38% after raising its profit forecast.

- 🏦 Fed Rate Cut Hopes: Comments from New York Fed President John Williams reportedly hinted at a possible rate cut in September, helping ease bond yields and boost equities.

- 🔋 Sector Strength: Energy stocks rose 1.15%, leading gains across 8 of the 11 S&P sectors.

Even with Nvidia’s post-bell dip, the broader market seems to be pricing in sustained AI growth and a more dovish Fed stance.

Are we now in an AI bubble?

Nvidia forward guidance is one of ‘slowing’.

Nvidia forecasts decelerating growth after a two-year AI Boom. A cautious forecast from the world’s most valuable company raises worries that the current rate of investment in AI systems might not be sustainable.