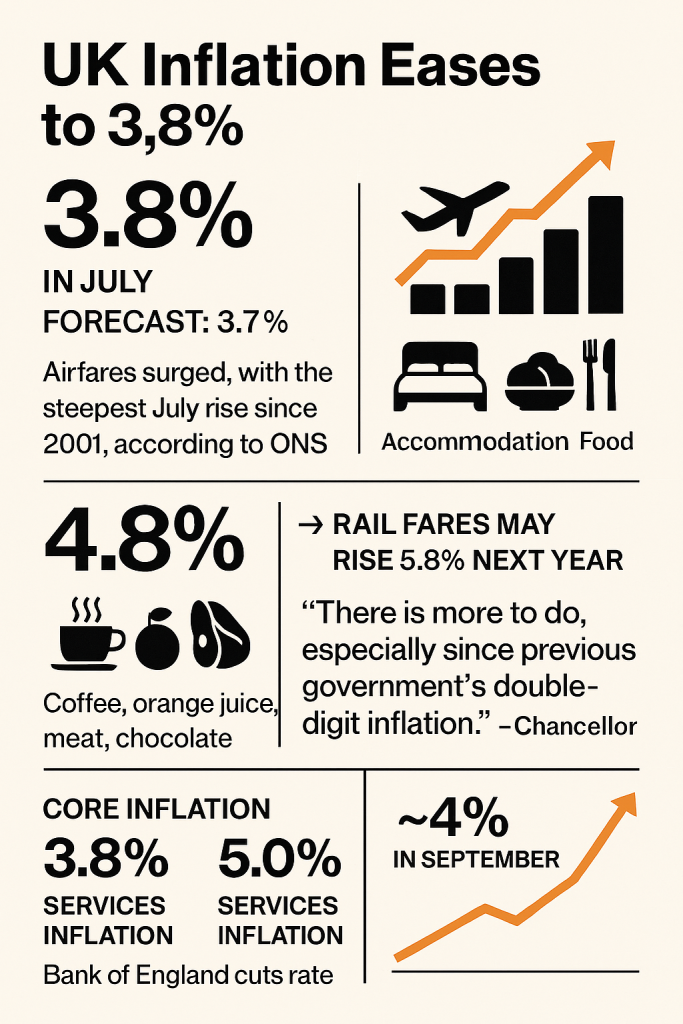

The UK’s annual inflation rate climbed to 3.8% in July, marking its highest level since January 2024 and outpacing economists’ forecasts of 3.7%.

The Office for National Statistics (ONS) attributed the unexpected rise to soaring airfares, elevated accommodation costs, and persistent food price pressures.

Transport costs were the primary driver, with airfares experiencing their steepest July increase since monthly tracking began in 2001.

Analysts suggest the timing of school holidays and a spike in demand—possibly amplified by high-profile events like the Oasis reunion tour—contributed to the surge.

Food inflation also continued its upward trend, with notable increases in coffee, fresh orange juice, meat, and chocolate.

The Retail Prices Index (RPI), which influences rail fare caps, rose to 4.8%, potentially signalling a 5.8% hike in regulated train fares next year.

Core inflation, which excludes volatile items such as energy and food, matched the headline rate at 3.8%, suggesting underlying price pressures remain stubborn.

Services inflation rose to 5%, reinforcing concerns that inflation may be embedding itself more deeply in the economy.

Despite the Bank of England’s recent rate cut to 4%, policymakers face a delicate balancing act. With inflation still nearly double the Bank’s 2% target, further monetary easing may be limited.

Chancellor Rachel Reeves acknowledged the challenge, stating that while progress has been made since the previous government’s double-digit inflation, ‘there’s more to do to ease the cost of living’.

Measures such as raising the minimum wage and expanding free school meals aim to cushion households from rising prices.

As inflation edges closer to a projected 4% peak in September 2025, the coming months will test both fiscal and monetary resilience.

Can we trust the data coming from the ONS?

See report here.