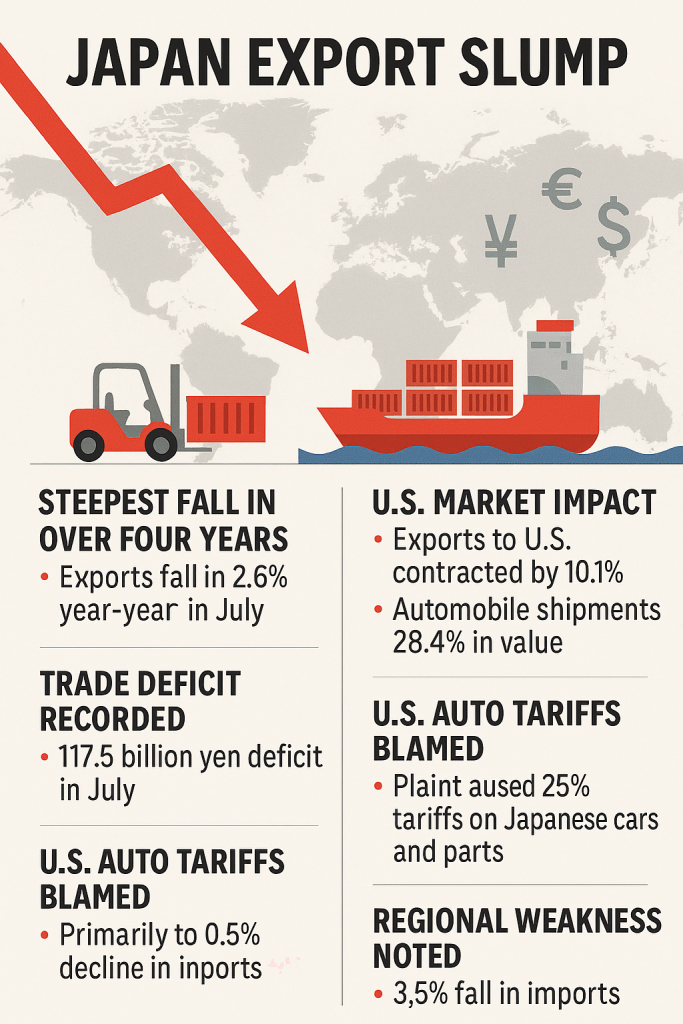

Japan’s economy has hit a troubling patch, with July 2025 marking its sharpest export contraction in over four years.

The Ministry of Finance reported a 2.6% year-on-year drop, driven largely by tariff led trade tensions and weakening global demand.

The most dramatic impact came from the United States, where exports fell 10.1%, led by a 28.4% plunge in automobile shipments.

This follows the U.S. administration’s decision to impose 25% tariffs on Japanese vehicles and auto parts in April—a move that has rattled Japan’s automotive sector, long a pillar of its export economy.

Despite a partial tariff rollback to 15% in July, the damage was already done. Japanese carmakers absorbed much of the cost to maintain shipment volumes, which only fell 3.2%, but the value loss was substantial.

Exports to China also declined by 3.5%, underscoring broader regional weakness. Meanwhile, imports dropped 7.5%, signalling sluggish domestic consumption and further strain on Japan’s trade balance, which recorded a 117.5 billion yen deficit.

Economists warn that if the export downturn continues, Japan could face a recession. Although Q2 GDP showed modest growth of 0.3%, the July figures suggest that momentum may be fading.

The Bank of Japan is now expected to hold off on interest rate hikes, with its next policy meeting scheduled for 19th September 2025.

As global markets digest the implications, Japan’s export slump serves as a stark reminder of how vulnerable even advanced economies can be to shifting trade policies and geopolitical headwinds.