Bitcoin has officially entered a bear market, having fallen more than 25% from its October peak of $126,000.

This downturn is rippling across the wider crypto sector, dragging Ethereum, Solana, and other altcoins into steep declines as investor sentiment turns risk-off.

Bitcoin’s recent plunge below $95,000 marks a decisive shift into bear market territory. After reaching an all-time high of $126,000 in early October, the cryptocurrency has shed over a quarter of its value in just six weeks.

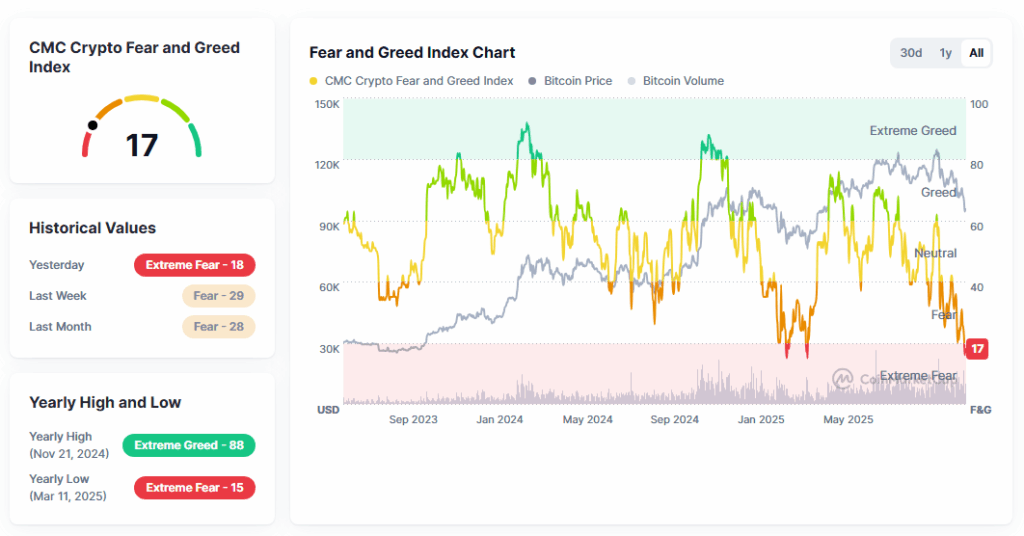

Analysts point to a combination of factors: fading hopes of Federal Reserve rate cuts, heavy outflows from Bitcoin ETFs, and broader weakness in technology. The sell-off has erased all of Bitcoin’s 2025 gains, leaving traders cautious and fearful.

This downturn is not isolated. Ethereum has dropped more than 30% from its highs, while Solana and Cardano have suffered double-digit losses.

The total crypto market capitalisation has fallen by approximately $1 trillion since October, underscoring how tightly correlated altcoins remain to Bitcoin’s trajectory.

When the flagship asset falters, liquidity drains across the sector, amplifying volatility.

Investor psychology has shifted dramatically. The ‘buy the dip’ mentality that defined earlier rallies is giving way to defensive strategies, with many now selling into strength rather than accumulating.

Long-term holders have reportedly offloaded hundreds of thousands of BTC in recent weeks, intensifying downward momentum. Meanwhile, ETF outflows — exceeding $1.6 billion in just three days — highlight waning institutional confidence.

For the broader crypto ecosystem, Bitcoin’s bear market signals a period of consolidation and caution. Altcoins, often more volatile, are likely to experience sharper swings.

Yet history suggests that such downturns can reset valuations, paving the way for healthier growth once macroeconomic conditions stabilise.

For now, however, the market remains firmly in risk-off mode, with Bitcoin leading the retreat.

The crypto sector faces nearing a $1 trillion wipeout, with investor sentiment shifting from optimism to fear.