Federal Reserve Chairman Jerome Powell stated on Wednesday 3rd April 2024 that policymakers will need time to assess the current inflation situation, leaving the schedule for potential interest rate reductions unclear.

Referring to the stronger-than-anticipated price pressures at the year’s onset, Powell reportedly stated that he and his colleagues are not in a hurry to relax monetary policy.

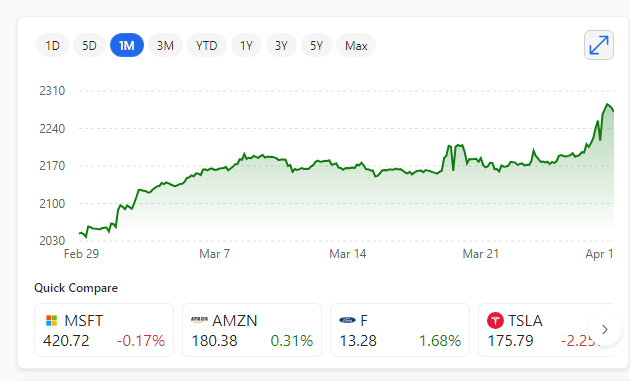

Market expectations are leaning towards the FOMC initiating policy easing this year, although adjustments to the anticipated timing and scale of reductions have been necessary due to persistently high inflation.

Meanwhile, other economic indicators, especially in the U.S. labour market and consumer spending sectors, remain robust, affording the Fed the opportunity to evaluate the prevailing situation prior to taking action.

The target rate is 2%.