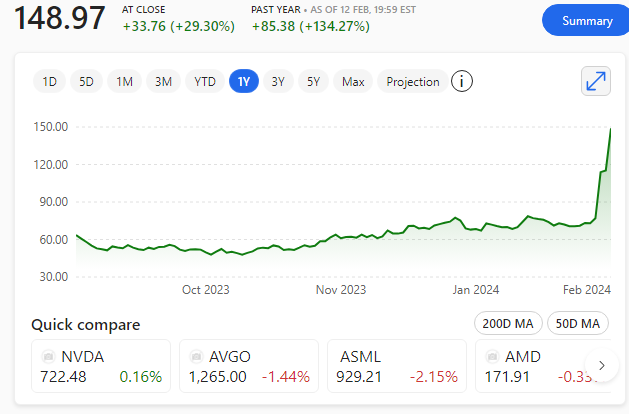

Jeff Bezos filed a statement indicating his sale of nearly 12 million shares of Amazon stock worth more than $2 billion

The Amazon executive chairman notified the U.S. SEC – Securities and Exchange Commission of the sale of 11,997,698 shares of common stock on the 7th and 8th February 2024.

The collective value of the shares of Amazon, which is based in Seattle where he founded the company in a garage around thirty years ago, was about $2.04 billion.

More to come

In a separate SEC filing, Bezos listed the proposed sale of 50 million Amazon shares on or around 7th February 2024 with an estimated market value of $8.4 billion.

Taxing decision?

Jeff Bezos moved from Seattle to Miami in November 2023, shortly before he announced his plan to sell up to 50 million Amazon shares by January 2025.

Florida does not have a capital gains tax, unlike Washington state, which imposes a 7% tax on any gains of more than $250,000 from the sale of stocks and bonds. Therefore, by moving to Florida, Bezos could save up to $600 million in taxes on his stock sale – more than enough for a luxury yacht and 2 or 3 more luxury properties.

But, of course, we do not know if this was the real reason for his move.