Fed holds U.S. rates at 5.5%, indicates three cuts coming in 2024

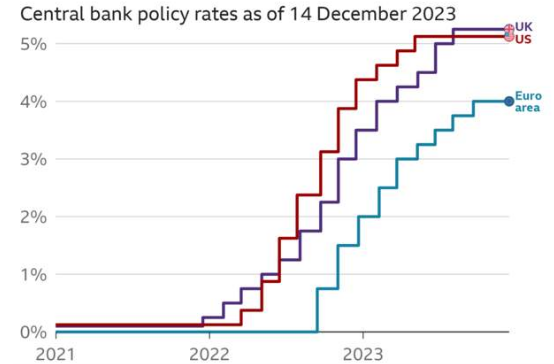

The Federal Reserve on Wednesday 13th December 2023 held its key interest rate steady for the third time in a row and set the scene for multiple rate cuts in 2024 and 2025.

With inflation easing and the economy holding up policymakers Federal Open Market Committee policymakers voted unanimously to keep the rate in a range between 5.25%-5.5%.

Possible three Fed rate cuts pencilled in for 2024

Along with the decision to stay on hold, the FOMC pencilled in at least three rate cuts in 2024, assuming quarter percentage point increments. That’s less than market pricing of four, but more aggressive than what officials had previously indicated.

Markets had widely anticipated the status quo decision which could end a cycle that has seen 11 hikes, pushing the interest rate to its highest level in more than 22 years. There was uncertainty, though, about how ambitious the FOMC might be regarding policy easing.

The FOMC’s so called ‘dot plot’ of individual members’ expectations indicate another four cuts in 2025, or a full 1%. Three more reductions in 2026 would take the Fed rate down to between 2%-2.25%, close to the longer-term outlook, though there were considerable difference in the estimates for the final two years.

Dow at new all-time high!

Following the Fed update the Dow Jones Industrial Average jumped more than 400 points, surpassing 37,000 for the first time creating a new Dow all-time high.