‘What are you doing with that?’ ‘I’m taking it to the treasury – nothing else seems to work!’

UK house prices have defied expectations by increasing slightly in June 2023 but annual prices fell at the fastest rate since 2009 as soaring mortgage costs took a toll on the market, according to Nationwide Building Society.

The surprise monthly rise of 0.1% reversed a 0.1% fall in May 2023 and surprised economic forecasts of a 0.3% fall! It pushed the average cost of a house in the UK up slightly to £262,239. House prices were 3.5% lower in June 2023 compared with a year earlier, the sharpest rate of decline since 2009.

The sharp increase in borrowing costs is likely to exert a significant drag on near-term housing market activity

It is important to note that the housing market is subject to fluctuations and can be influenced by various factors such as economic conditions, government policies, inflation, interest rate increases and global events.

This quote, from Wilde’s essay, ‘The Soul of Man Under Socialism‘, suggests that most people do not live fully or authentically, but merely survive or conform to society’s expectations.

Are we restricted by society to conform? Do the rich conform less than the poor? Is it a foregone conclusion that the poor conform more?

Who’s voice is heard above the noise?

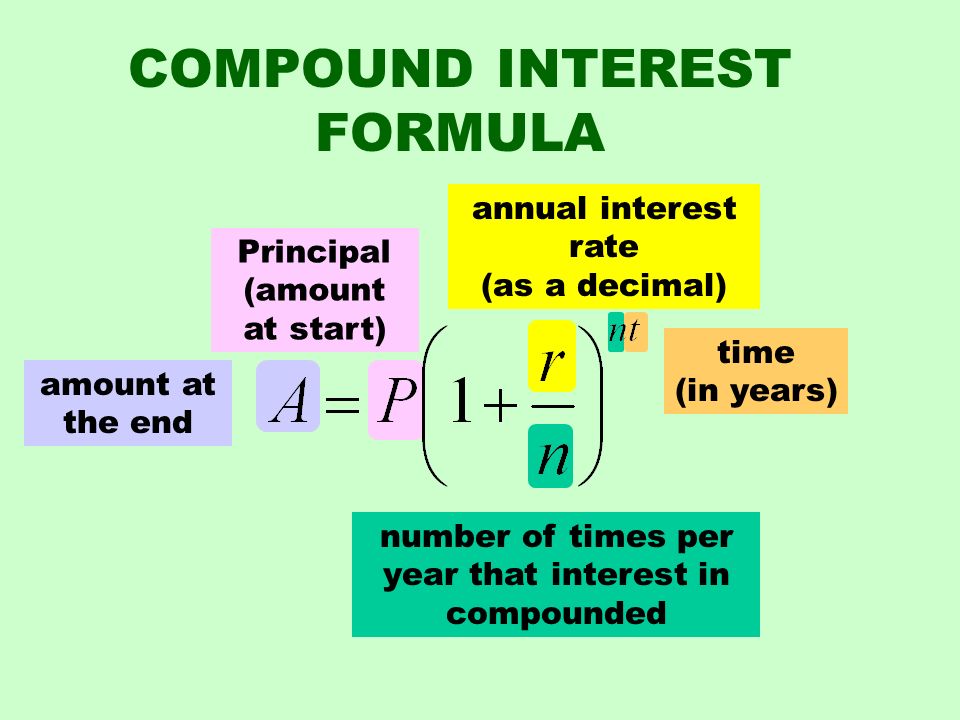

Compound interest is simply interest added back to the original or principal sum and then more interest is earned or calculated on ‘that’ added interest over the next compounding period.

Over a one year period: Take £1000 capital and add 5% interest (lucky if you can get it). That equals to £1050. That’s 1000 x 5% over 1 year = £1050.

Now this is the best bit…

Take your £1050 from the first year (original capital plus interest). Now, in year two it goes like this…

Take the new value £1050 capital add 5% interest again (but this time it is added to £1050 not just the original £1000).

That’s 1050 x 5% equals £1102.50 we’re compounding the interest on the £50 earned in the first year as well as the original capital.

It will be £1102.50 x 5% = £1157.63 and so on.

You can clearly see why it is important to take advantage of compound interest. Leaving your money in a savings account right now with such low interest rates isn’t a wise option. But when/if you can find a sensible interest rate COMPOUND interest will be your best friend.

Don’t just take my word for it. Compound interest is in very good company.

‘Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.’

He called it, ‘the greatest mathematical discovery of all time.’

Start £100,000.00

Year 1 £105,000.00

Year 2 £110,250.00

Year 3 £115,762.50

Year 4 £121,550.63

Year 5 £127,628.16

Year 6 £134,009.56

Year 7 £140,710.04

Year 8 £147,745.54

Year 9 £155,132.82

Year 10 £162,889.46

Year 1 £5,000.00

Year 2 £5,250.00

Year 3 £5,512.50

Year 4 £5,788.13

Year 5 £6,077.53

Year 6 £6,381.41

Year 7 £6,700.48

Year 8 £7,035.50

Year 9 £7,387.28

Year 10 £7,756.64

It’s time to compound your savings.

What are you waiting for… go do it now!

Crypto, short for cryptocurrency, is a digital or virtual currency that uses cryptography for security and operates independently of a central bank. Cryptocurrencies are decentralised currencies, meaning they’re neither issued nor governed by a central bank.

Some cryptocurrencies are issued by their developers, while others are generated by their respective network algorithms. They exist and operate on a public ledger called a blockchain, which records all crypto transactions. Blockchain encryption is designed to make all transactions safe and secure from tampering, counterfeit, and other forms of fraudulent transactions.

Cryptocurrencies can be stored in a ‘digital wallet’ on a smartphone or computer, and owners can send them to people to buy things. Although we can’t see or touch cryptocurrencies, they do hold value. Cryptocurrencies are now being used to purchase many different products and services, and some people are even buying cars and houses with their digital assets. They’re not widely used at the moment, but many believe the use of cryptocurrencies could one day become a common way to trade.

However, the future of cryptocurrency is uncertain and opinions are divided. Some predict that institutional money entering the market and the possibility of crypto being floated on the Nasdaq could add credibility to blockchain and its uses as an alternative to conventional currencies. Others predict that regulators around the world might come together on a global framework for crypto regulation, but this looks unlikely right now. It is impossible to predict the future of the crypto market with absolute certainty.

Despite a strong start to 2023, some analysts remain cautious on growth and predict pressure for digital assets. Cryptography and blockchains will continue to be integral parts of the modern economic toolkit.

In conclusion, while there is no consensus on whether crypto is the future of currency, it is clear that it has the potential to play a significant role in the future of finance.

There is evidence to suggest that the US, EU, UK and other nations are trying to regulate the crypto market. Some people in the crypto world believe that recent attempts to ring fence the crypto industry and cut off its connectivity to the banking system are reminiscent of a little-known Obama-era program called ‘Operation Choke Point’. This refers to a 2013 US government initiative that sought to cut off undesirable industries from banking services.

The sector was already under pressure, after prices of virtual currencies collapsed last year. Further damage came from the meltdown of several high-profile firms, including FTX, run by the so-called ‘Crypto King’ Sam Bankman-Fried, whom prosecutors have accused of conducting ‘one of the biggest financial frauds’ in US history. Jolted by the turmoil, US regulators stepped up their policing of the sector, which authorities say has been on notice since at least 2017 and that their activity runs afoul of US financial rules intended to protect US investors.

The campaign has yielded a steady drumbeat of charges against crypto firms and executives, alleging violations ranging from failing to register properly with authorities and provide adequate disclosure of their activity to, in some cases, more damaging claims such as mishandling of consumer funds and fraud. The crackdown culminated this month in legal actions against two of the biggest platforms: Coinbase and Binance.

However, during a hearing on cryptocurrency and blockchain technology regulation, Senate Banking Committee Chairman Mike Crapo shared his belief that the United States would not be able to succeed in banning Bitcoin.

In conclusion, while there is evidence that the US is trying to regulate the crypto market, it is not clear if they are trying to stop it completely and there is also evidence that suggests that the US would not be able to succeed in banning Bitcoin.

‘Operation Choke Point’ was allegedly an initiative of the United States Department of Justice that began in 2013 under the Obama administration. The program investigated banks in the United States and the business they did with firearm dealers, payday lenders, and other companies believed to be at a high risk for fraud and money laundering. It was an attempt by President Obama’s Department of Justice, the Federal Deposit Insurance Commission, the Consumer Financial Protection Bureau, and other government agencies to cut off banking and financial services for small businesses and industries that they deemed to be illegal enterprises or otherwise undesirable.

Digital currencies also became a target.

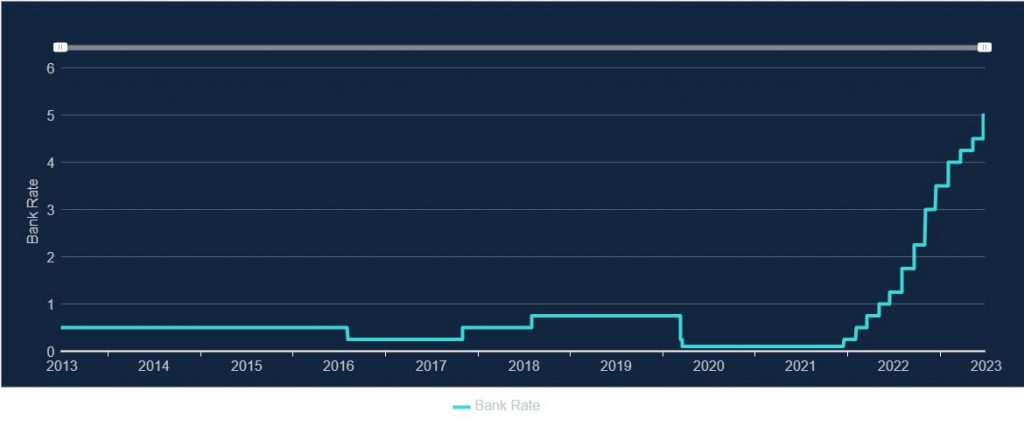

The UK is facing a cost of living crisis as inflation has soared to its highest level in decades. The Bank of England has raised interest rates 13 times since December 2021 in an attempt to bring inflation back down to its original target of 2%. But what does this mean for consumers, savers and borrowers?

The current UK interest rate is now: 5.0%

Inflation is the term used to describe rising prices. How quickly prices go up is called the rate of inflation. Inflation affects the purchasing power of money, meaning that the same amount of money buys less goods and services over time.

The rate of inflation in the UK is measured by two main indicators: the consumer price index (CPI) and the retail price index (RPI). The CPI is based on a basket of products and services that people typically buy, while the RPI also includes mortgage interest payments.

According to the Office for National Statistics (ONS), the CPI inflation rate was 8.7% in the year to May 2023, while the RPI inflation rate was 11.4%. This means that on average, prices were 8.7% and 11.4% higher respectively than they were a year ago.

The main drivers of inflation in the UK are:

Interest rates are the cost of borrowing money or the reward for saving money. The Bank of England sets the bank rate, which is the interest rate it charges to commercial banks that borrow from it. The bank rate influences other interest rates in the economy, such as mortgage rates, loan rates and savings rates.

The Bank of England uses interest rates as a tool to control inflation. The Bank has a target to keep inflation at 2%, but the current rate is more than five times that. When inflation rises, the Bank increases interest rates to make borrowing more expensive and saving more attractive. This reduces the amount of money circulating in the economy and slows down rising prices.

The Bank has raised interest rates 13 times since December 2021, from 0.1% to 5.0%. This is the highest level since March 2009, when interest rates were cut to a record low of 0.5% following the global financial crisis.

Higher inflation means that your money loses value over time. For example, if you had £100 in April 2022 and inflation was 8.7%, you would need £108.70 in April 2023 to buy the same amount of goods and services.

Higher inflation also affects your income, spending, saving and borrowing decisions.

There are some steps you can take to protect your money from inflation, such as:

Inflation and interest rates are two important factors that affect the UK economy and your personal finances. The UK is currently experiencing high inflation due to various factors, such as energy prices, shortages and demand. The Bank of England has raised interest rates to try to bring inflation back down to its target of 2%. Higher inflation and interest rates have implications for your income, spending, saving and borrowing decisions. You can take some steps to protect your money from inflation, such as reviewing your budget, shopping around, paying off debt, saving smartly and investing wisely.

How well has the Bank of England done to keep inflation at or close to 2%?

See next article…

On 29th. June 2023, Sir Richard Branson’s Virgin Galactic successfully launched its first commercial flight to the edge of space. The flight was carried out by the company’s SpaceShip Two space plane Unity with a special passenger on board: the company’s billionaire founder Richard Branson. Branson was accompanied by three crewmates and two pilots on the historic flight.

The flight took off from New Mexico in the US after being carried into launch position by Virgin Galactic’s carrier plane, Eve. The rocket ship reached an altitude of 53.5 miles above Earth’s surface before gliding back down to land at Spaceport America .

The vehicle flew high over the New Mexico desert on Thursday to enable three Italian astronauts to conduct science experiments in weightless conditions. Sir Richard will now begin sending up the 800 or so space flight customers who’ve bought tickets to ride on Unity.

The 72-minute mission took off from Spaceport America at 08:30 local time (14:30 GMT) and was livestreamed around the world.

Just under an hour into the mission, after reaching an altitude of 13,600m (44,500ft), the carrier plane, Eve, then released Unity to ignite its engine and boost up to the edge of space. At the top of its climb, the rocket ship was at an altitude of 279,00ft (85km), touching the edge of space.

This successful launch marks a major milestone for Virgin Galactic and the space tourism industry as a whole. With this achievement, Virgin Galactic has joined a small club of companies that can ferry paying customers to space, including Elon Musk’s SpaceX and Jeff Bezos’s Blue Origin.

Sir Richard Branson’s Virgin Galactic has made history with its successful rocket ship launch on June 29th, 2023. This achievement marks a significant milestone for the space tourism industry and opens up new possibilities for commercial space travel in the future.

The UK inflation rate remained at 8.7% in the year to May 2023, according to the latest official figures from the Office for National Statistics (ONS). This is the same rate that was recorded in April, but down from the 10.1% level seen in March.

The ONS said that rising prices for air travel, recreational and cultural goods and services, and second-hand cars resulted in the largest upward contributions to the annual inflation rate. However, these were offset by falling prices for motor fuel and food and non-alcoholic beverages.

The ONS also reported that core inflation, which excludes energy, food, alcohol and tobacco, rose to 7.1% in May, up from 6.8% in April, and the highest rate since March 1992.

The inflation rate is measured by the Consumer Prices Index (CPI), which tracks the changes in the cost of a basket of goods and services that are typically purchased by households. The CPIH, which includes owner occupiers’ housing costs, rose by 7.9% in the year to May, up from 7.8% in April.

The high inflation rate has been driven by a combination of factors, including supply chain disruptions, labour shortages, higher energy costs, and strong consumer demand as the economy recovers from the coronavirus pandemic.

The Bank of England has a target to keep inflation at 2%, but it has said that it expects inflation to rise further in the coming months before falling back next year. The Bank has also signalled that it may raise interest rates sooner than expected to curb inflationary pressures.

However, June’s inflation reading came in below economists expectations at 7.3% A small but welcome reversal of high UK inflation. UK inflation is higher than the EU and U.S.

Are central banks doing a good job at controlling inflation? Bear in mind the inflation target is 2%…

This is the Bank Rate set by the Bank of England (BoE), which influences the interest rates that other banks charge borrowers and pay savers. The BoE has raised the Bank Rate 13 times in a row from 0.1% to 5% in a bid to control inflation, which is the rate at which the prices of goods and services increase over time. The BoE has a target of keeping inflation at 2%, but the current inflation rate is 8.7%, which is much higher than the target. This means that the purchasing power of money is decreasing and people have to pay more for the same things.

Promoting the good of the people of the United Kingdom by maintaining monetary and financial stability.

Well, the BoE has clearly done a good job here then with the UK interest rate now at 5%, again… and inflation at 8.7% after peaking at 11.1% in November 2022, a 41 year high! Great job!

And the UK PM said, ‘I always said this would be hard – and clearly it’s got harder over the past few months. I am totally, 100%, on it, and it’s going to be OK‘.

That’s good to know then – it’s going to be OK – so reassuring for borrowers! It’s going to be OK, so don’t worry!

Sorry PM, but that is so weak it’s bordering pathetic. Weren’t you the chancellor too?