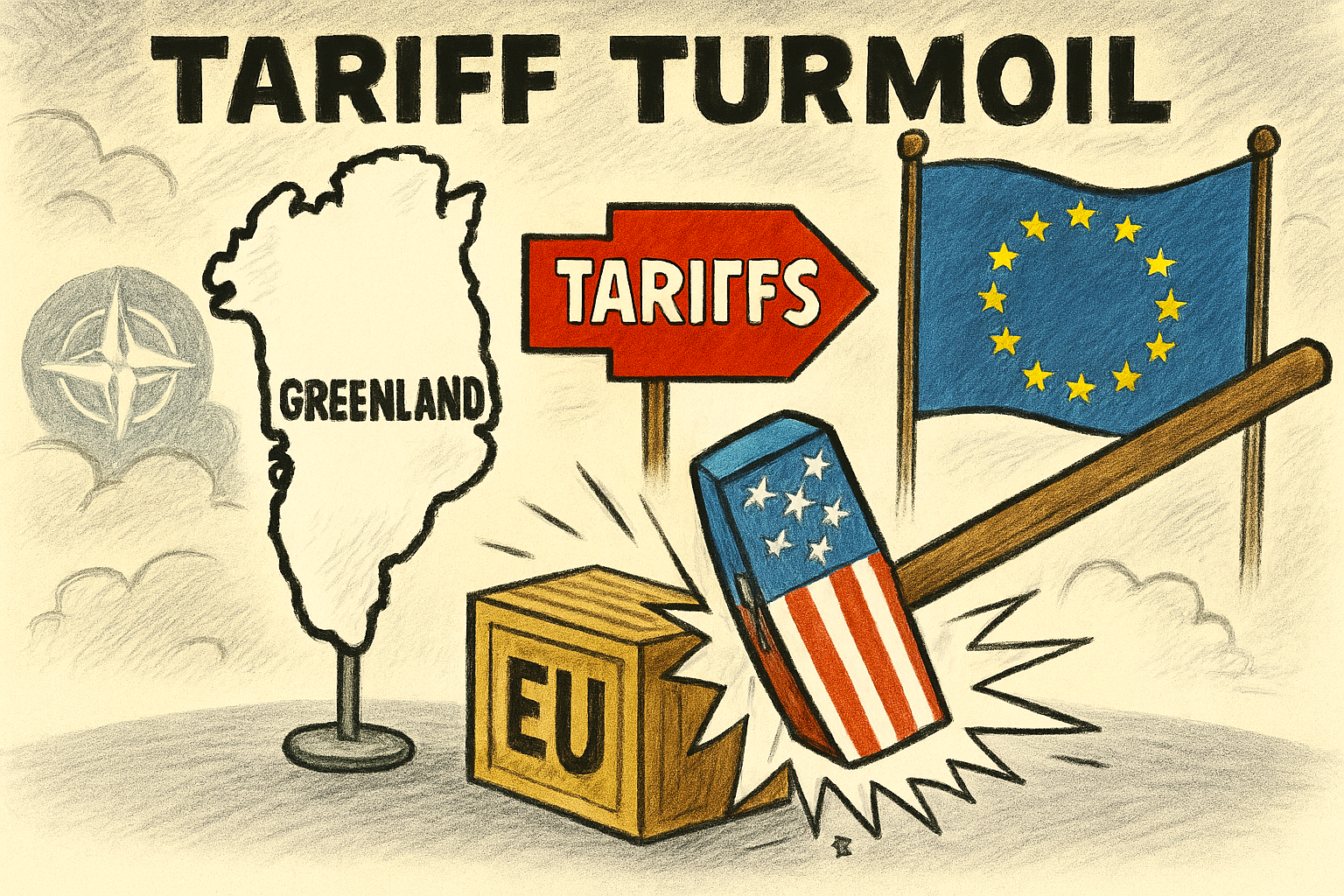

Donald Trump’s latest tariff broadside has sent a fresh tremor through Brussels, rattling diplomats who were already juggling NATO tensions and the lingering aftershocks of previous trade disputes.

This time, the spark is an unexpected one: Greenland

The controversy began when Trump revived his long‑standing frustration over what he describes as Europe’s ‘unfair’ economic advantage.

According to commentators, his renewed push for steep tariffs on EU goods is tied to a broader strategic grievance — namely, Europe’s refusal to support his administration’s interest in expanding U.S. influence in the Arctic, particularly around Greenland.

While the idea of purchasing the island was dismissed years ago, the geopolitical value of the Arctic has only grown, and Trump’s circle continues to frame Greenland as a missed opportunity that Europe ‘blocked’.

The EU, blindsided by the sudden escalation, now finds itself scrambling to interpret the move.

NATO tariff leverage

Analysts argue that the tariffs are less about economics and more about leverage within NATO.

Trump has repeatedly insisted that European members must increase defence spending, and some observers see the Greenland dispute as a symbolic pressure point — a reminder that the US expects alignment on strategic priorities, not just budget commitments.

Bullying?

European leaders, meanwhile, are attempting to project calm. Publicly, they describe the tariffs as disproportionate and counterproductive. Privately, officials admit that the timing is deeply inconvenient.

With several member states already facing domestic economic pressures, a transatlantic trade clash is the last thing they need.

Yet the EU is also wary of appearing weak. Retaliatory measures are reportedly being drafted, though diplomats insist they hope to avoid a spiral.

The fear is that a tariff war could fracture cooperation at a moment when NATO unity is already under strain.

For now, Europe waits — bracing for the next twist in a saga where Greenland, of all places, has become the unlikely fault line in transatlantic politics.