The world’s largest cloud providers are engaged in one of the most expensive technological races in history.

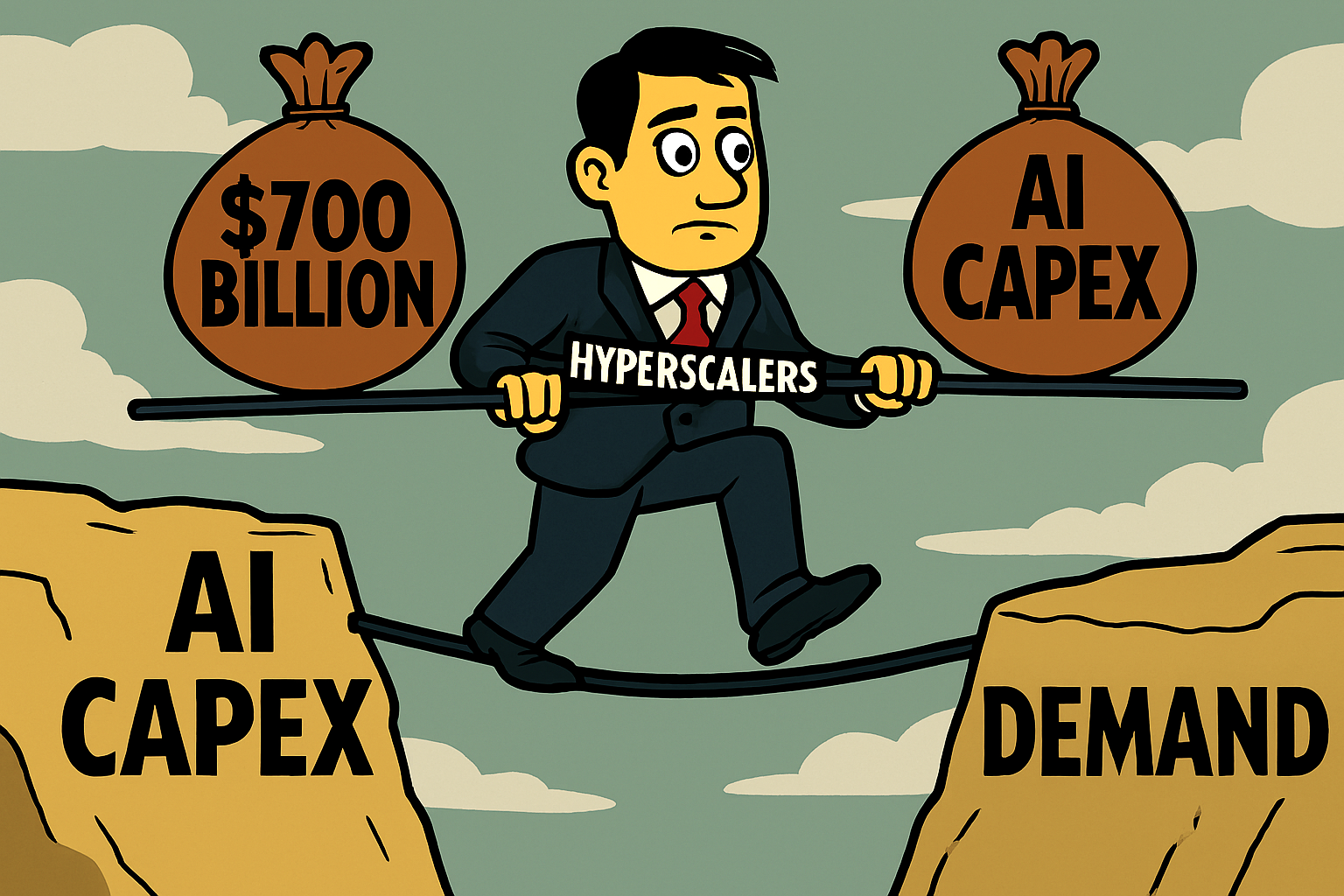

Amazon, Microsoft, Meta and Alphabet are collectively on track to spend as much as $700 billion on AI‑related capital expenditure this year — a figure that rivals the GDP of mid‑sized nations and has understandably rattled investors.

The question now dominating markets is simple: can hyperscalers justify this level of spending, and should analysts remain so bullish on their stocks?

A Binary Bet on the Future of AI

The scale of investment has shifted the AI build‑out from a strategic growth initiative to what some analysts describe as a binary corporate bet. As some analysts suggest, the leap in capex — up roughly 60% year‑on‑year — means the payoff must be both rapid and substantial.

If monetisation fails to keep pace, the consequences could be of severe concern.

This is compounded by the fact that hyperscalers are now consuming nearly all of their operating cash flow to fund AI infrastructure, compared with a decade‑long average of around 40%. That shift alone explains the recent market jitters.

Why Analysts Remain Upbeat

Despite the turbulence, many analysts still argue the long‑term fundamentals remain intact. One reason is that hyperscalers are pre‑selling data‑centre capacity before it is even built, effectively locking in revenue ahead of deployment.

That dynamic supports the bullish view that AI demand is not only real but accelerating.

There is also a belief that as AI tools become embedded across consumer and enterprise workflows, willingness to pay will rise sharply.

If that scenario plays out, today’s eye‑watering capex could look prescient rather than reckless.

The Real Risk: Timelines

The challenge is timing. Much of the infrastructure being deployed — from chips to data‑centre hardware — has a useful life of just three to five years.

That gives hyperscalers a narrow window to recoup investment before the next upgrade cycle hits.

Without clearer monetisation strategies and firmer payback timelines, investor anxiety is likely to persist.

AI capex justification?

Hyperscalers can justify their AI capex — but only if demand scales as quickly as they expect and monetisation becomes more transparent.

Analysts may be right to stay bullish, but the margin for error is shrinking. In the coming quarters, clarity will matter as much as capital.