Oracle Corporation has just staged one of the most dramatic rallies in tech history—catapulting itself into the elite club of near-trillion-dollar companies and reshaping the billionaire leaderboard in the process.

Founded in 1977 by Larry Ellison, Oracle began as a modest database software firm. Its first major boom came in the late 1990s, riding the dot-com wave as enterprise software demand exploded.

By 2000, Oracle’s market cap had surged past $160 billion, making it one of the most valuable tech firms of the era.

A second wave of growth followed in the mid-2000s, fuelled by aggressive acquisitions like PeopleSoft and Sun Microsystems, which expanded Oracle’s footprint into enterprise applications and hardware.

Boom

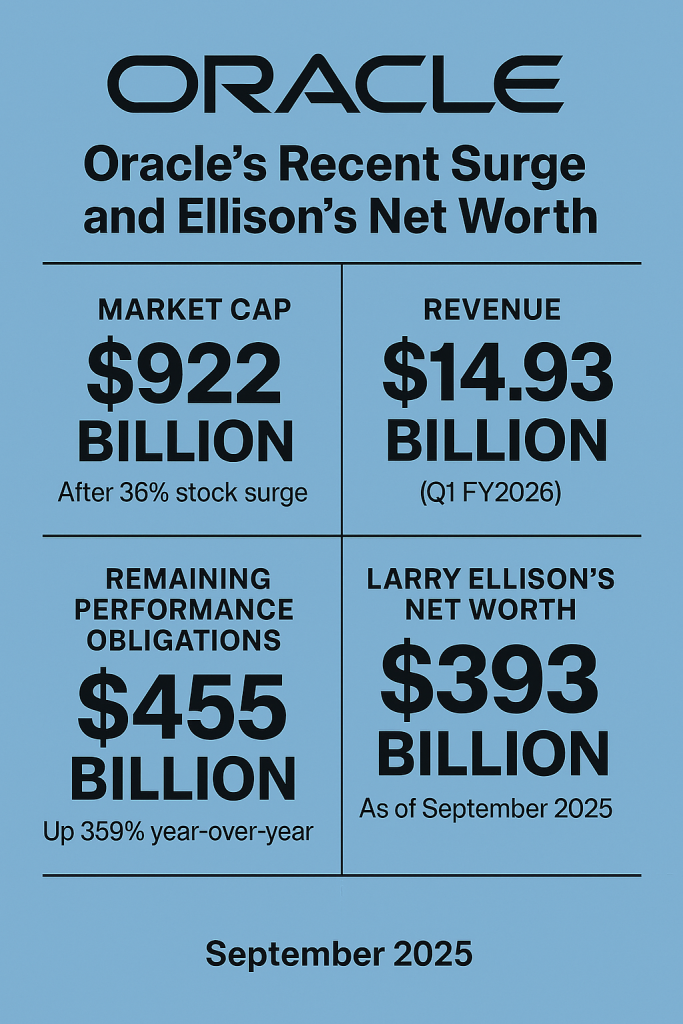

But its most recent boom—triggered in 2025—is unlike anything before. Oracle’s pivot to cloud infrastructure and artificial intelligence has paid off spectacularly. In its fiscal Q1 2026 report, Oracle revealed $455 billion in remaining performance obligations (RPO), a staggering 359% increase year-over-year.

This backlog, driven by multi-billion-dollar contracts with AI giants like OpenAI, Meta, Nvidia, and xAI, sent shockwaves through Wall Street.

Despite missing revenue and earnings expectations slightly—$14.93 billion in revenue vs. $15.04 billion expected, and $1.47 EPS vs. $1.48 forecasted—the market responded with euphoria.

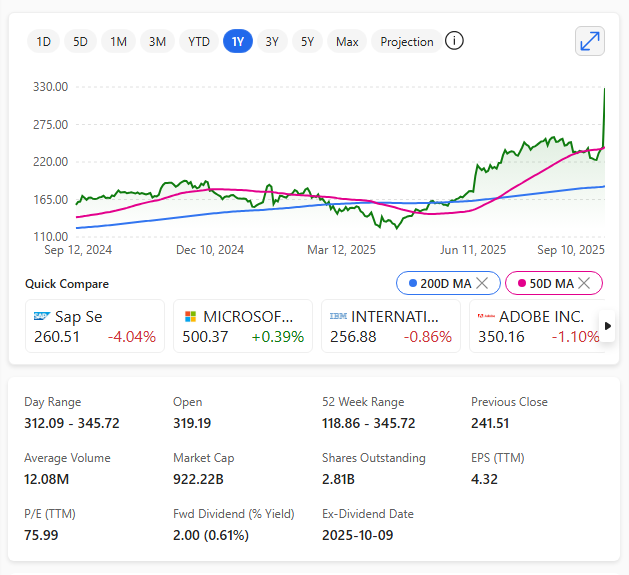

Oracle’s stock soared nearly 36% in a single day, adding $244 billion to its market cap and pushing it to approximately $922 billion. Analysts called it ‘absolutely staggering’ and ‘truly awesome’, with Deutsche Bank reportedly raising its price target to $335.

This meteoric rise had personal consequences too. Larry Ellison, Oracle’s co-founder and current CTO, saw his net worth jump by over $100 billion in one day, briefly surpassing Elon Musk to become the world’s richest person.

His fortune reportedly peaked at around $397 billion, largely tied to his 41% stake in Oracle. Ellison’s journey—from college dropout to tech titan—is now punctuated by the largest single-day wealth gain ever recorded.

CEO Safra Catz also benefited, with her net worth rising by $412 million in just six hours of trading, bringing her total to $3.4 billion. Under her leadership, Oracle’s stock has risen over 800% since she became sole CEO in 2019.

Oracle’s forecast for its cloud infrastructure business is equally jaw-dropping: $18 billion in revenue for fiscal 2026, growing to $144 billion by 2030. If these projections hold, Oracle could soon join the trillion-dollar club alongside Microsoft, Apple, and Nvidia.

From database pioneer to AI infrastructure powerhouse, Oracle’s evolution is a masterclass in strategic reinvention.

Oracle one-year chart 10th September 2025

And with Ellison now at the summit of global wealth, the company’s narrative is no longer just about software—it’s about legacy, dominance, and the future of intelligent computing.