Profits up!

Rolls-Royce share price soared by 20% in july 2023 after it raised its profit guidance and reported strong demand in its jet engine and defence businesses.

The company, which makes engines for aeroplanes, ships and submarines, repoertedly said it expects to make between £1.2 billion and £1.4 billion in underlying operating profit this year, up from its previous forecast of £800 million to £1 billion.

The profit upgrade reflects the improvement in Rolls-Royce’s operations under its new chief executive, who took over in January with a mandate to turn the companyaround. A transformation programme was launched to boost productivity, efficiency and innovation across all divisions. It appears to be working.

Drivers

One of the main drivers of Rolls-Royce’s recovery is the revival in air travel and flying hours as Covid restrictions were eased. The company charges customers for the number of hours its jet engines run, which have dramatically rebounded from the slump caused by the pandemic. Rolls-Royce said it expects to generate £750 million in free cash flow this year, up from its previous target of £500 million.

Another factor behind Rolls-Royce’s growth is the increased defence spending following Russia’s invasion of Ukraine. The company makes propulsion systems for Royal Navy warships and submarines, as well as engines for military aircraft. Rolls-Royce reportedly said its defence unit had delivered ‘exceptional‘ performance and secured new contracts.

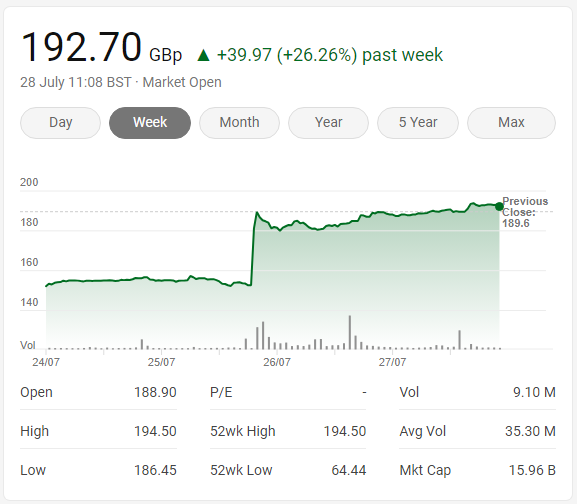

Share price hits 52 week high!

Rolls-Royce’s share price hit its highest level since March 2020, when the prospect of travel bans caused aviation-related stocks to plunge. The stock has almost doubled in value this year, making it the best-performing stock on the FTSE 100 over the past six months.

Analysts and investors have welcomed the signs of progress at Rolls-Royce, which had struggled with profitability and cash flow issues even before the pandemic.

Rolls-Royce is scheduled to report its half-year results next week, which are expected to show profits of between £660 million and £680 million some analysts suggest, more than double market expectations. The company said it remains confident in its medium-term outlook and its ability to deliver value for customers and shareholders.

Definitely one to watch. It’s been on my ‘share radar’ for a couple years now. Share price hit intraday high of £1.94 on 28th July 2023