The United States has intensified its tariff policies, marking a significant shift in global trade dynamics

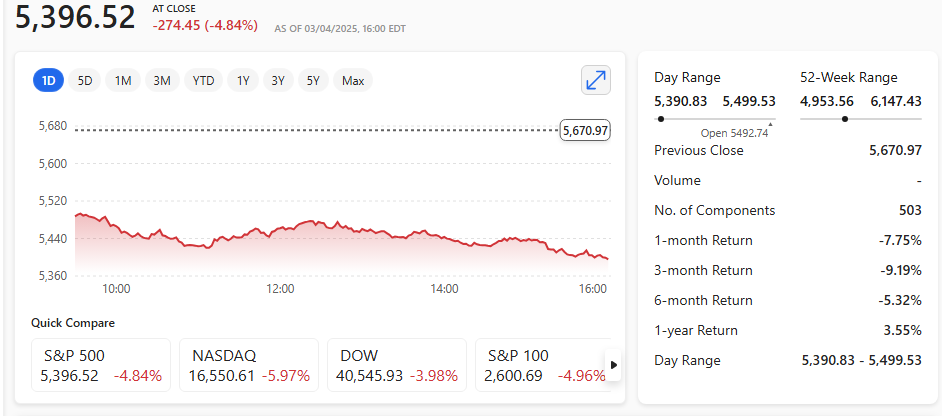

On 4th March 2025, President Donald Trump announced a sweeping increase in tariffs on steel and aluminum imports, raising them to 25% across the board. This move, aimed at bolstering domestic industries, has sparked widespread reactions both domestically and internationally.

The tariffs, which now include a broader range of products such as nuts, bolts, and soda cans, have drawn sharp criticism from key U.S. allies, including Canada, the United Kingdom, and Australia.

U.S and the EU

The European Union has responded with countermeasures, imposing tariffs on $28 billion worth of American goods, set to take effect on 1st April 2025. European Commission President Ursula von der Leyen expressed regret over the U.S. decision but emphasised the need to protect European consumers and businesses.

Domestically, the tariffs have been met with mixed reactions. While U.S. steel and aluminum producers have welcomed the measures, citing potential job creation and increased investment, downstream manufacturers that rely on these metals are bracing for higher costs.

Economists warn that the tariffs could lead to increased prices for consumers and potential disruptions in supply chains. Trump has indicated many times that the tariffs levelled at the U.S. are unfair and unequal.

The Trump administration has justified the tariffs as a means to encourage foreign companies to establish manufacturing facilities in the United States. However, critics argue that the policy could backfire, leading to retaliatory measures from trading partners and a potential slowdown in global economic growth.

As the global trade landscape continues to evolve, the long-term impact of these tariffs remains uncertain. Businesses and policymakers alike are closely monitoring the situation, weighing the potential benefits of protecting domestic industries against the risks of escalating trade tensions.

The coming weeks and months will be crucial in determining the effectiveness of this bold and possibly misguided economic strategy.

U.S. and Canada

The trade relationship between the U.S. and Canada has recently faced significant strain due to escalating tariff policies.

President Donald Trump announced a sharp increase in tariffs on Canadian steel and aluminum, raising them from 25% to 50%. This decision was reportedly in response to Ontario’s provincial government imposing higher electricity prices on U.S. customers.

However, after discussions between Ontario Premier Doug Ford and U.S. Commerce Secretary Howard Lutnick, Ontario agreed to pause the electricity surcharge.

As a result, the U.S. decided to maintain the original 25% tariff rate instead of doubling it. Despite this temporary resolution, tensions remain high, with Canada preparing to implement retaliatory tariffs on $30 billion worth of American goods.

These developments highlight the ongoing challenges in U.S. – Canada trade relations, with both nations navigating the complexities of economic and political interests.

U.S. and China

The U.S. – China trade tensions have escalated significantly in recent months. President Donald Trump recently imposed a 20% tariff on all imports from China, reportedly citing concerns over China’s role in the flow of fentanyl into the U.S.

This move has reignited the trade war that began during Trump’s first term.

In response, China has implemented retaliatory measures, including a 15% tariff on U.S. liquefied natural gas (LNG) and coal, as well as a 10% tariff on crude oil, agricultural machinery, and large-engine cars.

Additionally, China has restricted the export of rare earth minerals and metals, which are critical for U.S. tech and green energy industries.

Both nations have expressed a willingness to engage in dialogue, but the situation remains tense. The economic impact of these tariffs is being closely monitored, as they have the potential to disrupt global supply chains and affect industries worldwide.

U.S. and Mexico

The U.S. – Mexico trade conflict has intensified with the U.S. imposing a 25% tariff on Mexican imports, excluding oil and energy products, which face a 10% tariff.

This decision, aimed at addressing trade deficits and border concerns, prompted Mexico to announce retaliatory tariffs targeting $20 billion worth of U.S. goods. Critics argue these measures undermine the United States-Mexico-Canada Agreement (USMCA) and could disrupt supply chains.

Both nations are bracing for the economic impact, with businesses and consumers facing potential cost increases. This trade dispute highlights the challenges of balancing domestic priorities while maintaining strong international partnerships in a connected global economy.

And there’s more…

Russia and Ukraine peace deal according to Trump. Taking rare earth and other minerals from Ukraine in a ‘deal’. The potential reshaping of Gaza to become the riviera of the middle east. Talk of taking over Greenland. Making Canada the 51st state. etc. etc.

And this is just what we already know after 8 weeks of Trump in power!