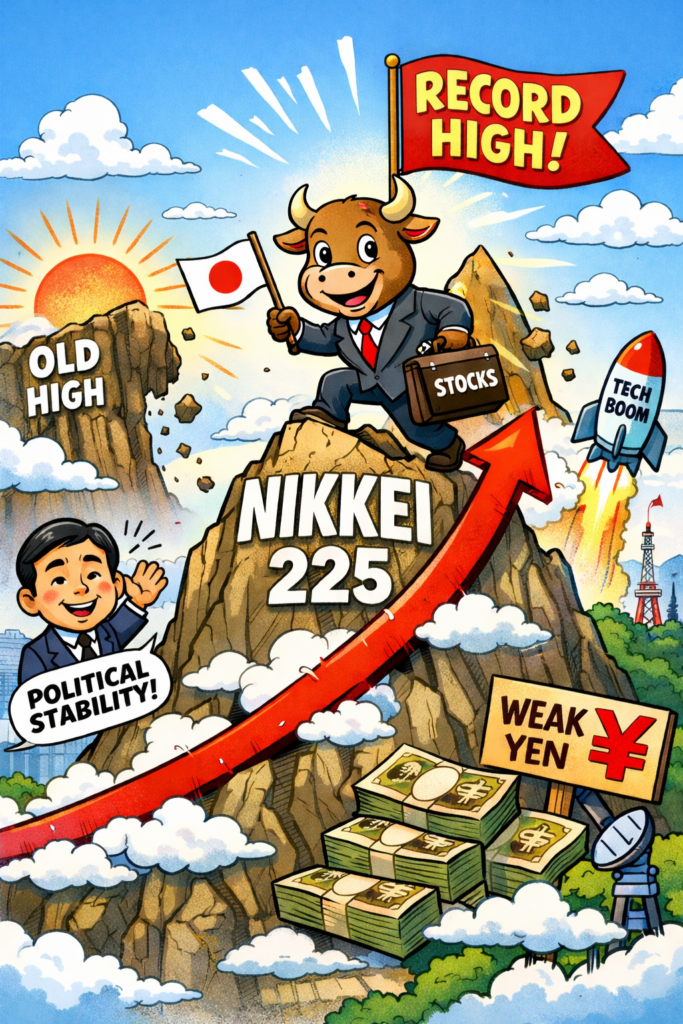

Japan’s Nikkei 225 has surged to a series of record highs, signalling a decisive shift in investor sentiment as political clarity, a weak yen, and global tech momentum converge.

The index has climbed well beyond its previous peaks, driven by strong demand for semiconductor and AI‑linked stocks, alongside renewed confidence in Japan’s economic direction.

The index is hitting repeated all‑time highs

The Nikkei has surged to fresh record levels — closing around 57,650 and even touching 57,760 in early trade. This marks consecutive days of record closes.

In previous intraday trading the Nikkei 225 touched 58,500.

The driver: the ‘Takaichi trade’

Markets are reacting strongly to Prime Minister Sanae Takaichi’s landslide election victory, which has created expectations of:

Looser economic policy

Increased fiscal stimulus

A more stable political environment

Investors are effectively pricing in a pro‑growth agenda with fewer legislative obstacles.

Much of the rally reflects expectations of a more expansionary policy environment. Investors are likely betting that the government will prioritise growth, support corporate investment, and maintain a stable backdrop for reform.

This has amplified interest in heavyweight exporters and technology firms, which stand to benefit both from global demand and the yen’s prolonged softness.

Weaker Yen?

The currency’s slide towards multi‑decade lows has been a double‑edged force: while it boosts overseas earnings for major manufacturers, it also raises the prospect of intervention from policymakers keen to avoid excessive volatility.

For now, markets appear comfortable with the trade‑off, focusing instead on the competitive advantage it provides.

With global equity markets still heavily influenced by AI enthusiasm and shifting monetary expectations, Japan’s resurgence stands out.

The Nikkei’s latest ascent suggests investors are increasingly willing to treat Japan not as a defensive allocation, but as a genuine engine of growth in its own right.