Financial markets have always been sensitive to political noise, but the current climate has taken that sensitivity to an absurd extreme.

Performance please

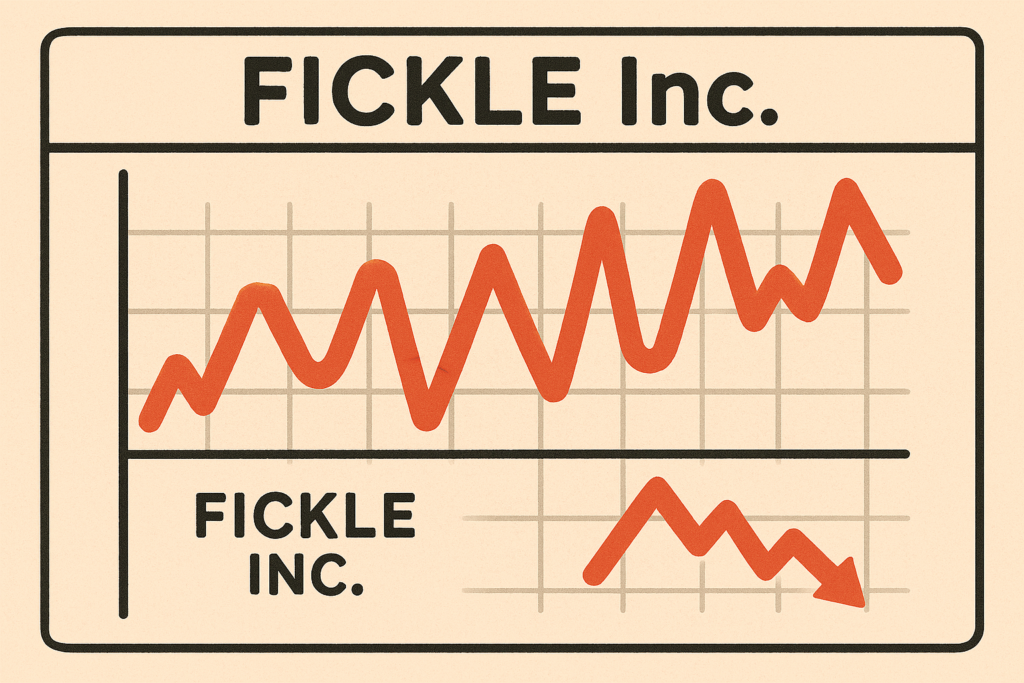

Share prices no longer rise and fall on the strength of a company’s performance, innovation, or long‑term strategy. Instead, they twitch in response to diplomatic spats, off‑the‑cuff remarks, and theatrical posturing on the world stage.

Spectacle

The spectacle is becoming depressingly familiar. A leader makes a provocative comment at a summit, threatens tariffs, or insults an ally, and within minutes markets wobble – go down and then go back up again.

Rational

Investors who once prided themselves on rational analysis now find themselves reacting to geopolitical melodrama rather than fundamentals.

It is as though diplomacy has become a form of market manipulation—unpredictable, performative, and entirely detached from the real value of the businesses being traded.

Bankers

Layered on top of this is the increasingly interventionist behaviour of central banks. Their signals, hints, and carefully staged ‘surprises’ often overshadow the actual economic data they claim to interpret.

Markets respond less to the health of the economy and more to the tone of a speech or the phrasing of a press release.

Unhealthy

This is not a healthy system. When diplomacy becomes theatre and monetary policy becomes a guessing game, markets lose their grounding in reality.

The result is volatility without purpose, confidence without substance, and a financial landscape driven more by ego than economics.

I want stability for my investments. A stable environment where the quality and success of a company will win through.

I do not want a ‘hit and miss comment gamble driven market’ where remarks push the share prices around, usually to the benefit of the ‘remark maker’.

It just isn’t right!

And it’s just an opinion.