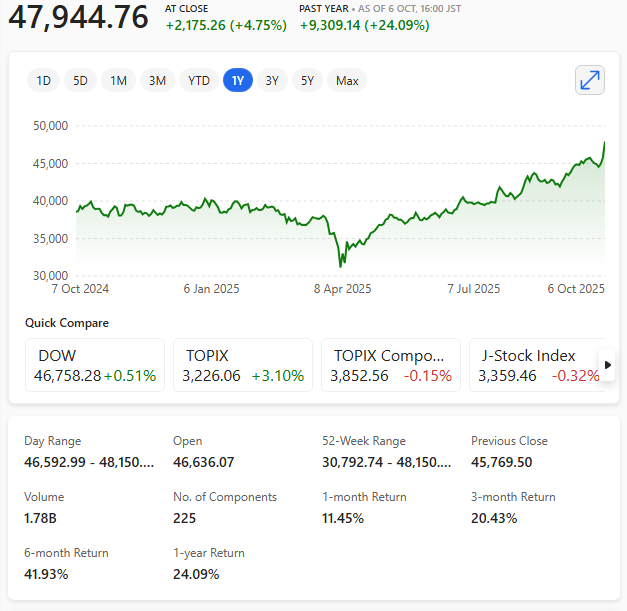

Japan’s benchmark Nikkei 225 index soared past the symbolic 48,000 mark on Monday 6th October 2025 in intraday trading, marking a new all-time high and underscoring investor confidence in the country’s shifting political landscape.

The index closed at 47944.76, up approximately 4.15% from Friday’s session, driven by a wave of optimism surrounding the Liberal Democratic Party’s leadership transition.

Sanae Takaichi, a staunch conservative with deep ties to former Prime Minister Shinzo Abe, has emerged as the frontrunner to lead the party—and potentially become Japan’s first female prime minister.

Her pro-growth stance, admiration for Margaret Thatcher, and commitment to industrial revitalisation have sparked hopes of continued economic liberalisation.

The yen weakened boosting export-heavy sectors such as automotive and electronics. Toyota and Sony led the charge, with gains of 5.1% and 4.8% respectively.

Analysts also pointed to easing U.S. bond yields and a rebound on Wall Street as contributing factors.

While the rally reflects renewed market enthusiasm, it also raises questions about Japan’s long-term structural challenges—from demographic decline to mounting public debt.

For now, however, the Nikkei’s ascent offers a potent symbol of investor faith in Japan’s evolving political and economic narrative.