Nvidia has once again (unsurprisingly) defied expectations, reporting record-breaking third-quarter results that underscore its dominance in the artificial intelligence chip market.

Nvidia’s Latest Financial Results

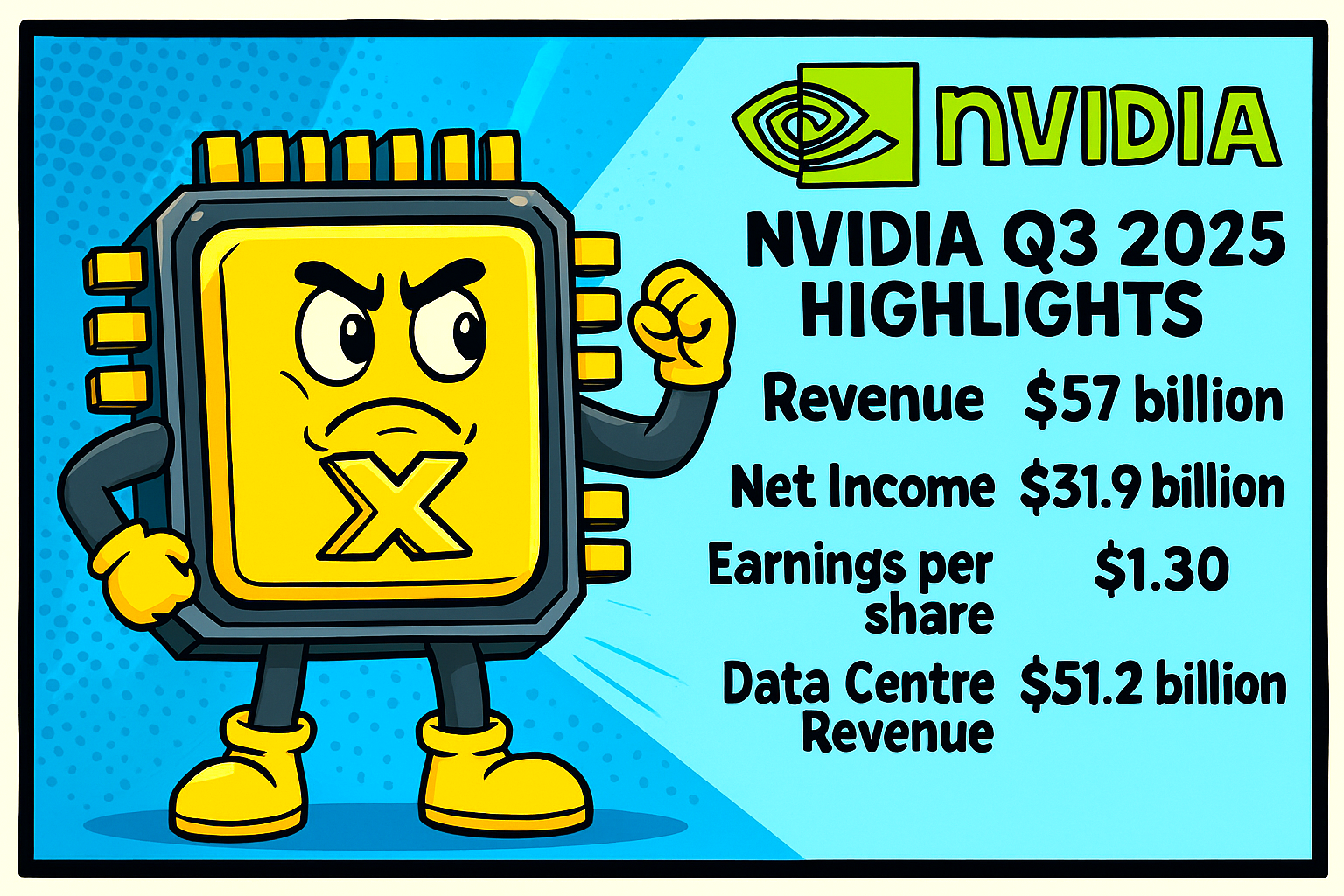

Nvidia announced revenue of $57 billion for the quarter ending 26th October 2025, a 62% increase year-on-year and up 22% from the previous quarter.

Net income surged to $31.9 billion, a remarkable 65% rise compared with last year. Earnings per share came in at $1.30, comfortably ahead of analyst forecasts of $1.26.

The company’s data centre division was the star performer, generating $51.2 billion in revenue, up 25% from the previous quarter and 66% year-on-year.

This reflects the insatiable demand for Nvidia’s Blackwell AI chips, which CEO Jensen Huang reportedly described it as ‘off the charts‘ with cloud GPUs effectively sold out.

Market Impact and Outlook

Shares of Nvidia rose sharply following the announcement, adding to a 39% gain in 2025 so far. Analysts had anticipated strong results, but the scale of growth exceeded even bullish expectations.

Options markets had priced in a potential 7% swing in Nvidia’s stock after earnings, highlighting investor sensitivity to its performance.

Looking ahead, Nvidia has issued guidance of $65 billion in revenue for the fourth quarter, signalling continued momentum.

Huang reportedly emphasised that AI demand is compounding across both training and inference, creating what he called a ‘virtuous cycle’ for the industry.

Strategic Significance

Nvidia’s results reinforce its position at the centre of the global AI boom. Its chips power everything from large language models to robotics, and the company is benefiting from widespread adoption across industries.

With margins above 73%, Nvidia is not only growing rapidly but also maintaining enviable profitability.

The figures highlight how Nvidia has become more than a semiconductor company—it is now a cornerstone of the digital economy.

As AI applications proliferate, Nvidia’s ability to scale production and meet demand will be critical in shaping the next phase of technological transformation.

In short: Nvidia’s Q3 results show explosive growth, record revenues, and a confident outlook, cementing its role as the leading force in AI hardware.

Nvidia CEO reportedly remarked…

‘There’s been a lot of talk about an AI bubble‘, Nvidia CEO Jensen Huang reportedly told investors. ‘From our vantage point, we see something very different’.

As to what that means exactly is up to you to decipher. Regardless of what the AI industry has to offer in the future, from an investor’s point of view, Nvidia’s earnings are clearly something to celebrate.

Is AI in a bubble, or not?