U.S. Inflation was flat in October from the previous month, providing a positive sign that high prices are finally easing their tight grip on the U.S. economy. Is this also a green light for the Federal Reserve to stop raising interest rates.

The consumer price index (CPI) was flat in October 2023 from the previous month but up 3.2% from a year ago. Both were below analysts’ estimates, sparking a major stock market rally.

Excluding volatile food and energy prices, the core CPI rose 0.2% and 4%, against the forecast of 0.3% and 4.1%. The annual rate was the smallest increase since September 2021.

The flat reading on the headline CPI came as energy prices declined 2.5% for the month, offsetting a 0.3% increase in the food index.

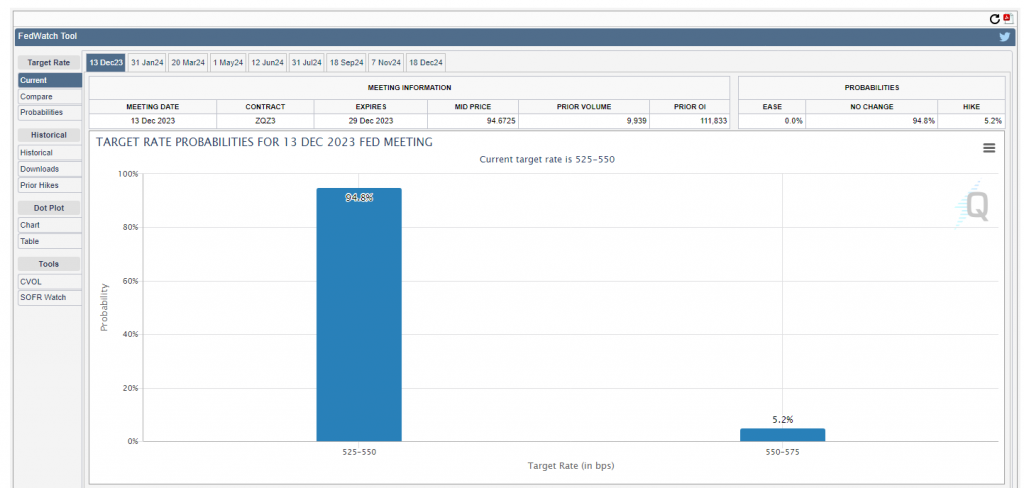

Traders do not anticipate that the Fed will raise interest rates in December 2023, according to data from the CME Group.

U.S. Treasury yields fall

U.S. Treasury yields fell on Tuesday 14th November 2023 as key inflation data showed a surprisingly ‘soft’ change in prices last month.

The 10-year Treasury yield fell to about 4.45%. The 2-year Treasury yield fell more to under 4.9%.

Good data

Inflation stabilising, yields falling and equities up – are the stars aligning for a stock market rally leading into Christmas 2023?