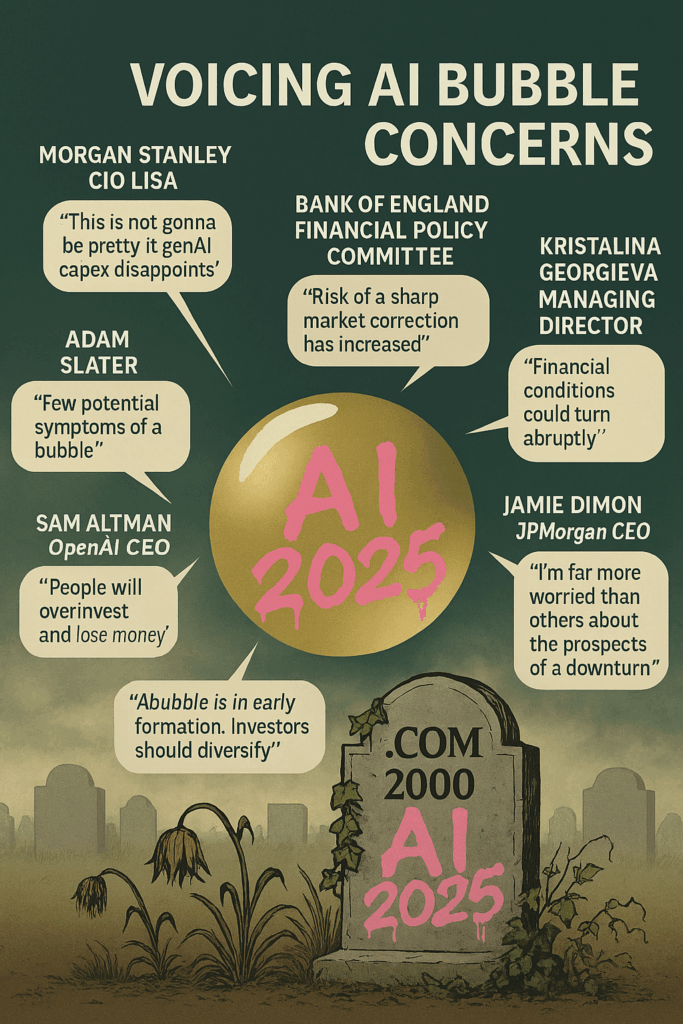

Influential figures and institutions are sounding the AI alarm—or at least raising eyebrows—about the frothy valuations and speculative fervour surrounding artificial intelligence.

Who’s Warning About the AI Bubble?

🏛️ Bank of England – Financial Policy Committee

- View: Stark warning.

- Quote: “The risk of a sharp market correction has increased.”

- Why it matters: The BoE compares current AI stock valuations to the dotcom bubble, noting that the top five S&P 500 firms now command nearly 30% of market cap—the highest concentration in 50 years.

🏦 Jerome Powell – Chair, U.S. Federal Reserve

- View: Cautiously sceptical.

- Quote: Assets are “fairly highly valued.”

- Why it matters: While not naming AI directly, Powell’s remarks echo broader concerns about tech valuations and investor exuberance.

🧮 Lisa Shalett – Chief Investment Officer, Morgan Stanley Wealth Management

- View: Deeply concerned.

- Quote: “This is not going to be pretty” if AI capital expenditure disappoints.

- Why it matters: Shalett warns that 75% of S&P 500 returns are tied to AI hype, likening the moment to the “Cisco cliff” of the early 2000s.

🌍 Kristalina Georgieva – Managing Director, IMF

- View: Watchful.

- Quote: Financial conditions could “turn abruptly.”

- Why it matters: Georgieva highlights the fragility of markets despite AI’s productivity promise, warning of sudden sentiment shifts.

🧨 Sam Altman – CEO, OpenAI

- View: Self-aware caution.

- Quote: “People will overinvest and lose money.”

- Why it matters: Altman’s admission from inside the AI gold rush adds credibility to bubble concerns—even as his company fuels the hype.

📦 Jeff Bezos – Founder, Amazon

- View: Bubble-aware.

- Quote: Described the current environment as “kind of an industrial bubble.”

- Why it matters: Bezos sees parallels with past tech manias, suggesting that infrastructure spending may be overextended.

🧠 Adam Slater – Lead Economist, Oxford Economics

- View: Analytical.

- Quote: “There are a few potential symptoms of a bubble.”

- Why it matters: Slater points to stretched valuations and extreme optimism, noting that productivity projections vary wildly.

🏛️ Goldman Sachs – Investment Strategy Division

- View: Cautiously optimistic.

- Quote: “A bubble has not yet formed,” but investors should “diversify.”

- Why it matters: Goldman acknowledges the risks while maintaining that fundamentals may still justify valuations—though they advise caution.

🧠 Julius Černiauskas and the Oxylabs AI/ML Advisory Board

🔍 View: The AI hype is nearing its peak—and may soon deflate.

- Černiauskas warns that AI development is straining environmental resources and public trust. He’s pushing for responsible and sustainable AI practices, noting that transparency is lacking in how many models operate.

- Ali Chaudhry, research fellow at UCL and founder of ResearchPal, adds that scaling laws are showing their limits. He predicts diminishing returns from simply making models bigger, and expects tightened regulations around generative AI in 2025.

- Adi Andrei, cofounder of Technosophics, goes further: he believes the Gen AI bubble is on the verge of bursting, citing overinvestment and unmet expectations

🧠 Jamie Dimon on the AI Bubble

🔥 View: Sharply concerned—more than most as widely reported

- Quote: “I’m far more worried than others about the prospects of a downturn.”

- Context: Dimon believes AI stock valuations are “stretched” and compares the current surge to the dotcom bubble of the late 1990s.

📉 Key Warnings from Dimon

- “Sharp correction” risk: He sees a real danger of a sudden market pullback, especially given how AI-related stocks have surged disproportionately—like AMD jumping 24% in a single day after an OpenAI deal.

- “Most people involved won’t do well”: Dimon told the BBC that while AI will ultimately pay off—like cars and TVs did—many investors will lose money along the way.

- “Governments are distracted”: He criticised policymakers for focusing on crypto and ignoring real security threats, saying: “We should be stockpiling bullets, guns and bombs”.

- “AI will disrupt jobs and companies”: At a trade event in Dublin, he warned that AI’s ubiquity will shake up industries and employment across the board.

And so…

The AI boom of 2025 has ignited a speculative frenzy across global markets, with tech stocks soaring and investors piling into anything labelled “AI-adjacent.”

But beneath the euphoria, a chorus of high-profile warnings is growing louder. From the Bank of England and IMF to JPMorgan’s Jamie Dimon and OpenAI’s Sam Altman, concerns are mounting that valuations are dangerously stretched, capital is overconcentrated, and the narrative is outpacing reality.

Dimon likens the moment to the dotcom bubble, while Altman admits many will “lose money” chasing the hype. Analysts point to classic bubble signals: retail mania, corporate FOMO, and earnings divorced from fundamentals.

Even as AI’s long-term utility remains promising, the short-term exuberance may be setting the stage for a sharp correction.

Whether it’s a pullback or a full-blown crash, the mood is shifting—from uncritical optimism to wary anticipation.

The question now is not whether AI will change the world, but whether markets have priced in too much, too soon.

We have been warned!

The AI bubble will pop – it’s just a matter of when and not if.

Go lock up your investments!