The latest figures on UK pay growth and unemployment present a complex picture of the country’s labour market.

The unemployment rate has seen a slight uptick to 4.2%, a rise from the previous 3.9%. This increase, which is more than anticipated, suggests a softening in the labour market.

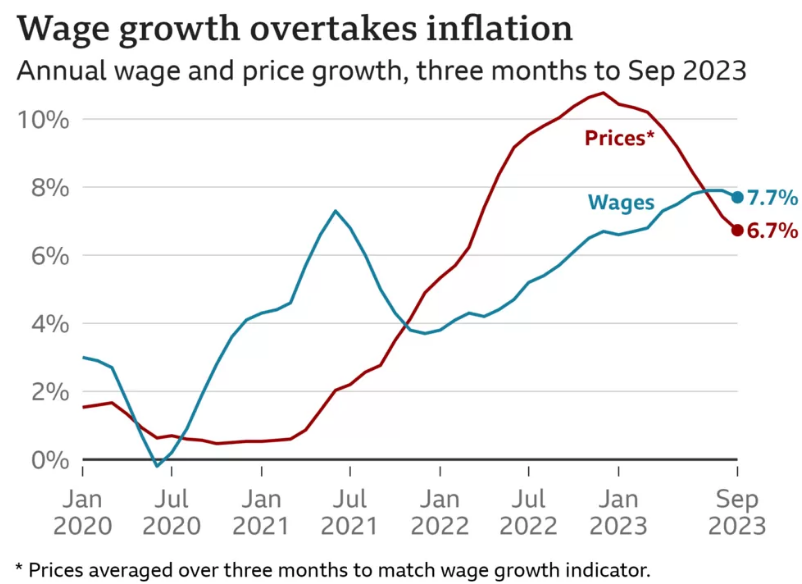

Conversely, wage growth appears to be resilient in the face of rising unemployment. Although core wage growth has decelerated, it remains in the region of 6%. This could indicate that employers are maintaining competitive wages to attract and retain skilled workers, even amidst a slowing labour market.

Employment dipped according to the ONS

The ONS said employment rate dipped to 74.5% between December and February and the percentage of 16 to 64 year-olds defined as economically inactive rose from 21.8% to 22.2%, which equates to 9.4 million people.

In February 2024, the average weekly earnings were estimated at £677 for total earnings and £633 for regular earnings. This equates to an annual growth in regular earnings (excluding bonuses) of 6.0%, and annual growth in employees’ average total earnings (including bonuses) of 5.6%.

Adjusting for inflation using CPIH

However, when adjusted for inflation using the Consumer Prices Index including owner occupiers’ housing costs (CPIH), the real terms growth for regular pay was 1.9%, and for total pay was 1.6%. This implies that while nominal wages are increasing, the real purchasing power of these wages may not be keeping up with inflation.

Bank of England

The Bank of England will likely approach this data with caution. The combination of increasing unemployment and slowing wage growth could be indicative of a weakening economy, potentially prompting the Bank to contemplate rate cuts.

The response of the Bank of England to these trends will be pivotal in the forthcoming months.

Summary

In summary, the UK labour market is exhibiting signs of cooling with an increase in unemployment and a slowdown in wage growth. However, wages continue to grow at a relatively high rate. The real impact on workers will hinge on how these wage increases stack up against inflation.